Forex Journalling – Growing from good to great as a Forex trader

Forex Journalling – Growing from good to great as a Forex trader

No shortcuts necessary, finding real solutions instead of a quick fix.

Forex trading can be a rollercoaster, especially when you are within the learning phases of trying to find your identity within the market as a forex trader.

Sure, we can all sign up to signal services, pay a monthly fee and be told when to set buy and sell limits and when to take profit; but is this trying to find a shortcut? Are we attempting to find a quick answer to a longer term deeper desire of actually being a forex trader instead of pretending to be one?

Forget watching what others do, begin analysing what YOU do!

Signal services, hand holding and relying on watching other trader’s Sunday instagram lives serves a short term solution, but you will never develop your own independence within the market unless you can master your own identity and your own way of doing things when it comes to trading the financial markets.

What happens when the trader you watch every week suddenly stops giving out free trades or doing Instagram lives breaking down the markets?

You have to learn how to stand on your own two feet, make your own decisions and learn to pull the trigger on your own trades based on the analysis you have regardless if 1,000 people are telling you to do the opposite. This will allow you to find your way and build confidence within your personal trading strategy.

The single biggest turnaround for me when I was within the learning phase of grasping forex was journaling. Sure I use to backtest different things, but nothing beats journalling live trades both winning and losing positions over a long period of time. I call this phase of your forex journey ‘Refinement and filtration’

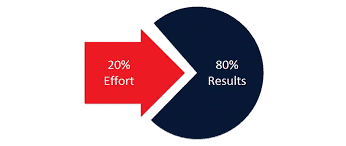

The way you do anything is the way you do everything! Use the 80/20 rule.

I strongly believe in the 80/20 rule, meaning 20% of the things you do within the markets produce 80% of the results. Potential traders believe the more indicators, the more moving averages and the more lines they have placed on their charts, the better the result.

This could not be further from the truth. Simplicity is key and refinement is the turning point. You cannot refine or find what works, how it works and what it works with and under what circumstances unless you are consistently journalling every move you are making.

Understanding the journalling process

When I first begun journalling I would spend 3-4 hours on a Sunday when the market was still analysing 14 pairs. I would narrow those pairs down to 8 or so which provided the best risk to reward ratio and provided the best set ups for the week ahead. Once I had filtered the highest probable trades I would then screenshot every pair on both the daily and then the 4HR timeframe and place them in a folder on my desktop named (week ahead) and the date for the beginning of the week. Each screenshot would contain multiple notes and all the reasons I believed the trade would go in the direction I anticipated.

When I looked back on these screenshots the following week it allowed me to reflect on what I was thinking when I first analyzed the pair and what happened during the week. This provided me with data and a result in which I could refine what worked best and remove the things which clearly served no purpose.

After 3 months of consistently doing this I begun to see patterns with which confluences worked best in harmony together and my strategy became so tight and refined the entire process was no longer diluted with indicators, lines, and mess. Instead the final result was simplicity, clarity and a clear understanding and direction.

Here is your challenge going forward

So I challenge you to document everything you do within the market including your emotions, thoughts and ask yourself exactly what the reasons were for taking the trade and the result. Time and time again during my mentoring 1-1 sessions I do with my students I put them on the spot and ask ‘What exactly were your reasons for taking this trade’ most of the time they cannot provide me an answer because when they look back, they had no journal, no thought process documented and really no reasons to take the trade.

Journalling and backtesting is a covered as a module within the course structure. If you have not yet taken a look, be sure to check out exactly how I journal my trades by purchasing the course and joining both the weekly analysis telegram group and the members community telegram which is an added benefit of becoming a course purchase member.

Latest News

Q2_Week_27_2022: Market Outlook

Currencies: Another week, another USDOLLAR high being formed! The dollar shows no signs of stopping, even after yesterday's CPI inflation data came in above consensus. 8.8% inflation was expected and 9.1% was the actual. We are looking to continue this trend going up,...

Q2_Week_26_2022: Market Outlook

Currencies: The USDOLLAR has continued its push up this week, forming new highs. The dollar has had such a strong run over the last few months and doesn’t show any sign of stopping. That being said, as soon as we see the FED pivot – this could cause some changes and...

Q2_Week_24_2022: Market Outlook

Currencies: The USDollar has continued to push up over the last couple of weeks. However, we have hit into monthly resistance, and we may see a deeper pullback because of it. That being said, due to us still being bullish we should continue to buy the dollar until...

Q2_Week_21_2022: Market Outlook and Trader’s Tips

Currencies: This week we have seen further downside on the USDOLLAR as anticipated. We are looking for this to continue for now, but we do need to be careful due to fundamentals out today and tomorrow for the dollar. Although the dollar has been moving down, the...