Currencies:

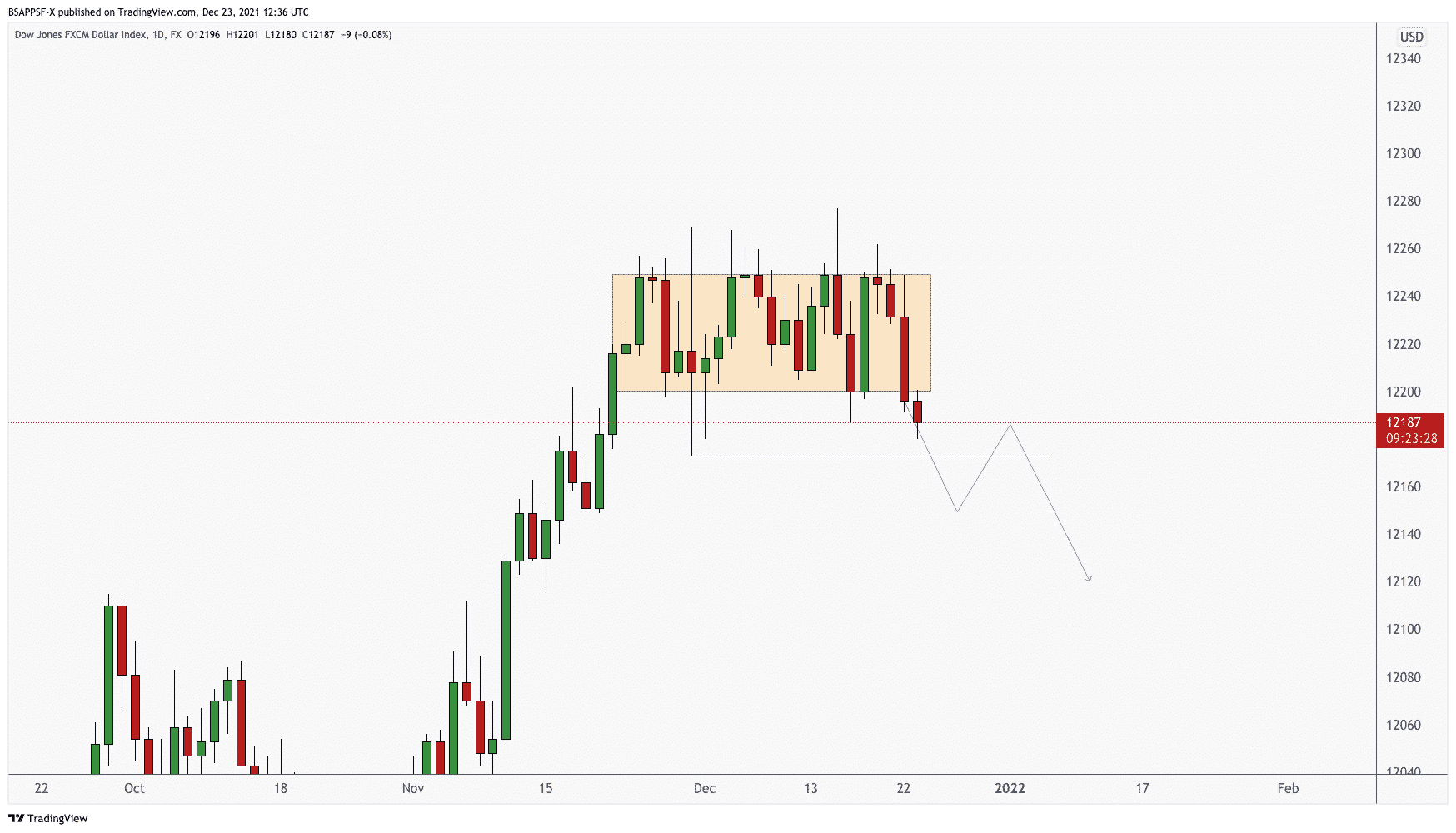

The dollar has continued to consolidate in its range, something which it has been doing for the last 28 days now. However it does seem like we may breakout to the downside now, which as you know from our previous blog posts, is our favoured direction. We will have to wait for price action to confirm but a strong daily candle closure outside of the range, preferably breaking 12173, would give me confidence that we are heading lower.

The Christmas holidays are nearly upon us, so expect a slow down towards the end of this week. However, the final week of the year tends to be quite a big mover most years – so stay sharp as we head into next week.

We do have some USD fundamentals out today, so this may continue to push the dollar down.

Upcoming fundamental releases we have are:

Thursday, December 23rd

- USD, Durable Goods Orders(Nov)

- USD, Nondefense Capital Goods Orders ex Aircraft(Nov)

USDollar Daily

Traders Tips – Yearly Review

The end of the year is fast approaching now, and this is the perfect opportunity to reflect on everything that’s happened. I really like doing yearly reviews, because it allows me to see what I had done right – and things that I could improve on… and then set these as goals for next year. It helps maintain that cycle of continuous growth we all should be aspiring to do.

I split my yearly review up into different sections.

The first section is trading itself. I will reflect on my results for the year, review my journals and try find any commonalities as to the times when I was trading at my best or my worst. Anything I find from this can then be incorporated into my trading plan to ensure I am trading to my highest level as much as I can. I will also reflect on the statistics of these journals as well and see if there is anything, in relation to technicals, that can be improved upon.

The next section is reflecting on how the markets have been over the last year as well. It’s a known fact that the market goes into cycles, where we have busy periods and quieter periods. I really like going back through to see If there were any reasons as to why this happened – were there any fundamentals at play during those times? What was the dollar or the other baskets doing during those times? Of course, you won’t find an answer for everything – the market does what it likes most the time. But if you can find certain trends, then it’s something you can look out for going into next year.

The final section of my yearly review is my reflecting on my own personal life. This includes goals which I set out to achieve, where I am in my life currently and more. This is a very personal section, but it is what you make it. Reflecting on things such as relationships, health and money is important to be continuously growing in all areas of your life. Because trading is affected by these other factors– so making sure these are in a good place is crucial.

It is easy to be hung up over the wins or the losses during this year. However, once you have done your review, just start working towards the goals you have set for 2022.

This will be the last blog post of the year, so I hope you all have a great Christmas and happy New Year!

Written by Aqil – Head Analyst