Currencies:

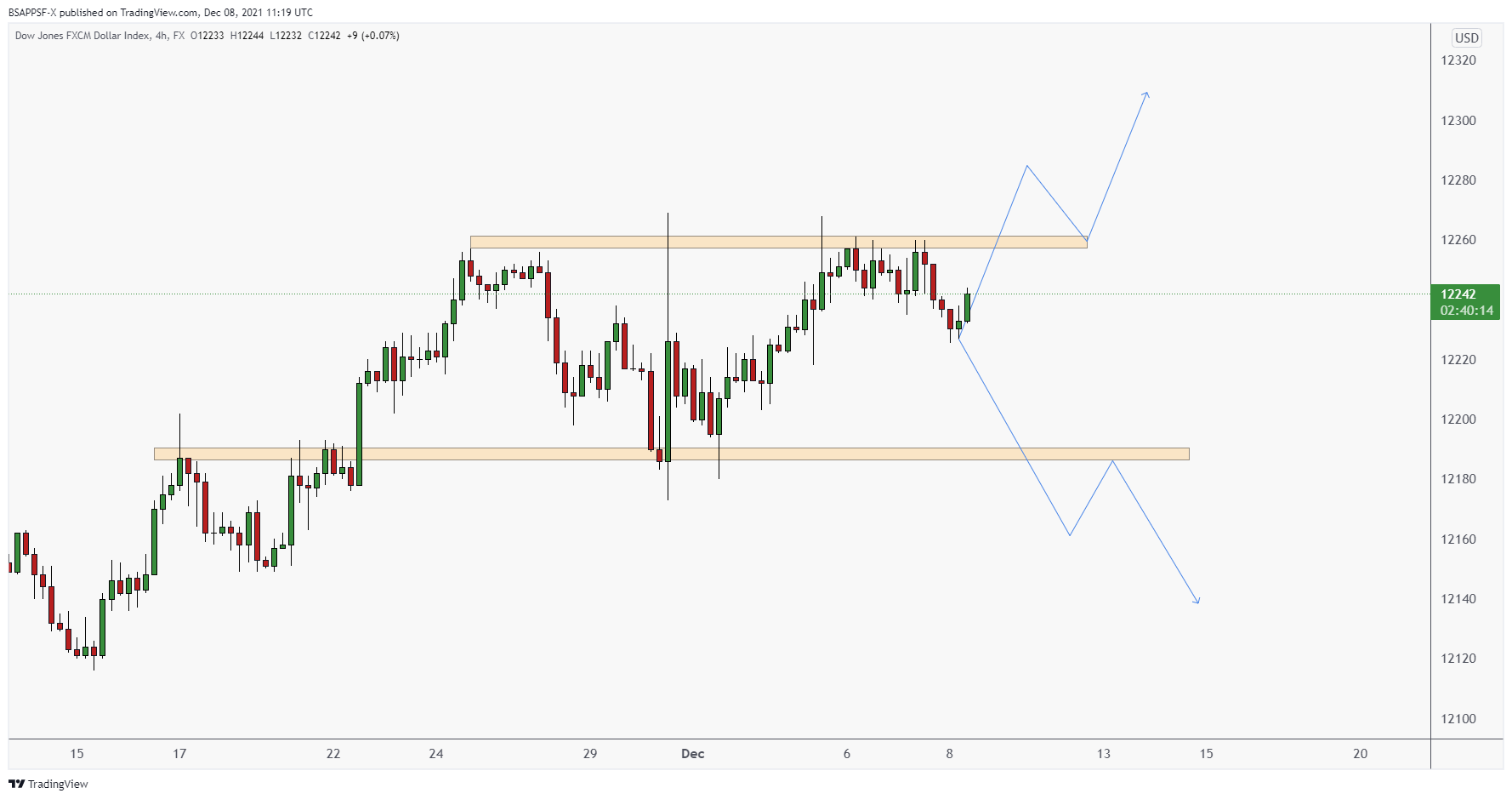

The dollar has continued to stall around the area covered last week. We did see an initial reaction off it, but have since pulled back and tapped into 12268 again. We will be monitoring price on the lower time-frame and wait for the breakout – we can then look to trade the pullback of this move.

The GBP is looking weak right now. There are loads of ongoing issues within the UK’s economy – one of which is a labour shortage:

Inflation and wages rise with fewer people in jobs market. Concern that pressures once thought ‘transitory’ will persist. The pain appears to be more acute in Britain than the U.S. and the euro area, according to Bank of England officials, with the impact of Brexit colliding with the pandemic. Before the emergence of the omicron variant, the OECD warned that a persistent shortage of workers in the U.K. could slow what is forecast to be the fastest growth rate among the Group of Seven major economies. The threat of wage inflation, meanwhile, helps explains why the BOE is widely expected to raise interest rates before the U.S. Federal Reserve. Ref:Bloomberg

Upcoming fundamental releases we have are:

Wednesday, December 8th

- CAD, BOC Interest Rate Decision

- CAD, BoC Rate Statement

- AUD, RBA’s Governor Lowe speech

Thursday, December 9th

- CNY, Consumer Price Index (YoY)(Nov)

Friday, December 10th

- EUR, Harmonized Index of Consumer Prices (YoY)(Nov)

USDollar 4HR

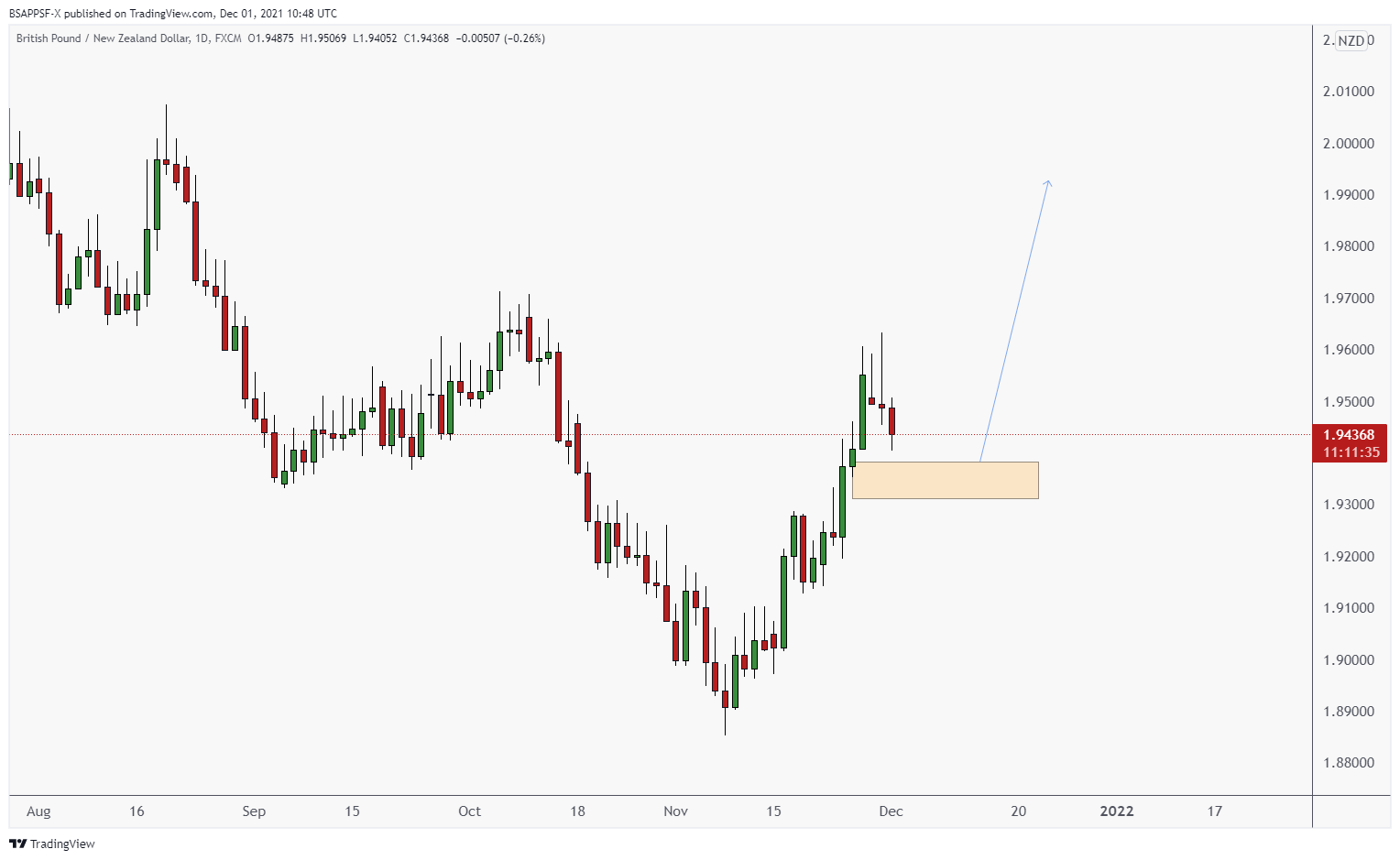

UPDATE: POTENTIAL SETUP: GBPNZD

GBPNZD Daily (01/12)

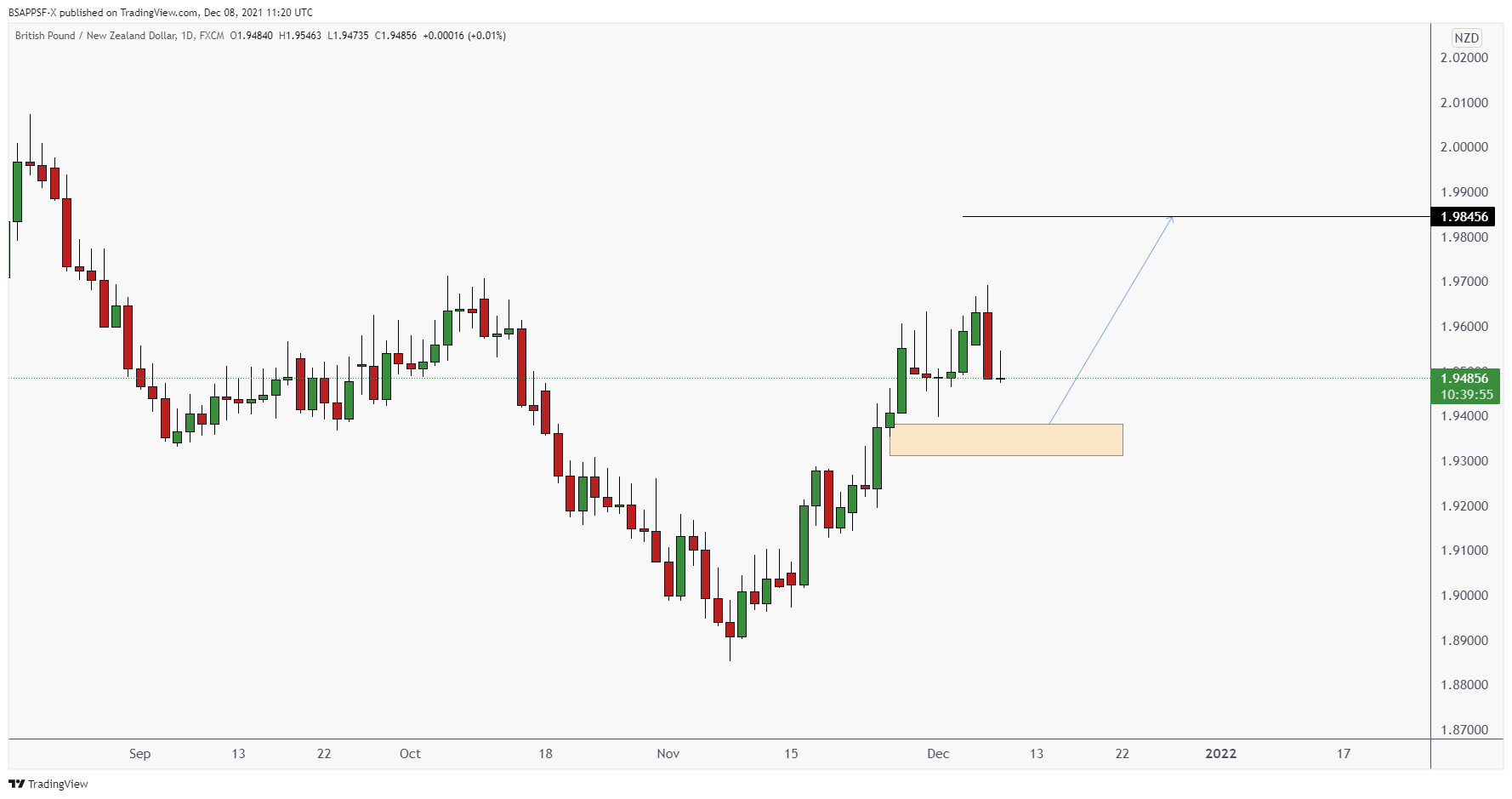

GBPNZD Daily

As mentioned last week, we are watching GBPNZD for a long position. We have failed to push down into the area of interest; however, we do believe we can still see a push down into it. Again, we will need to assess the price action when we reach this area as this would serve as confirmation that we are reacting. If you want to understand what we mean by this, tune into our Instagram live every Thursday, where we break down pairs, you can ask questions, educational lessons and more!