Currencies:

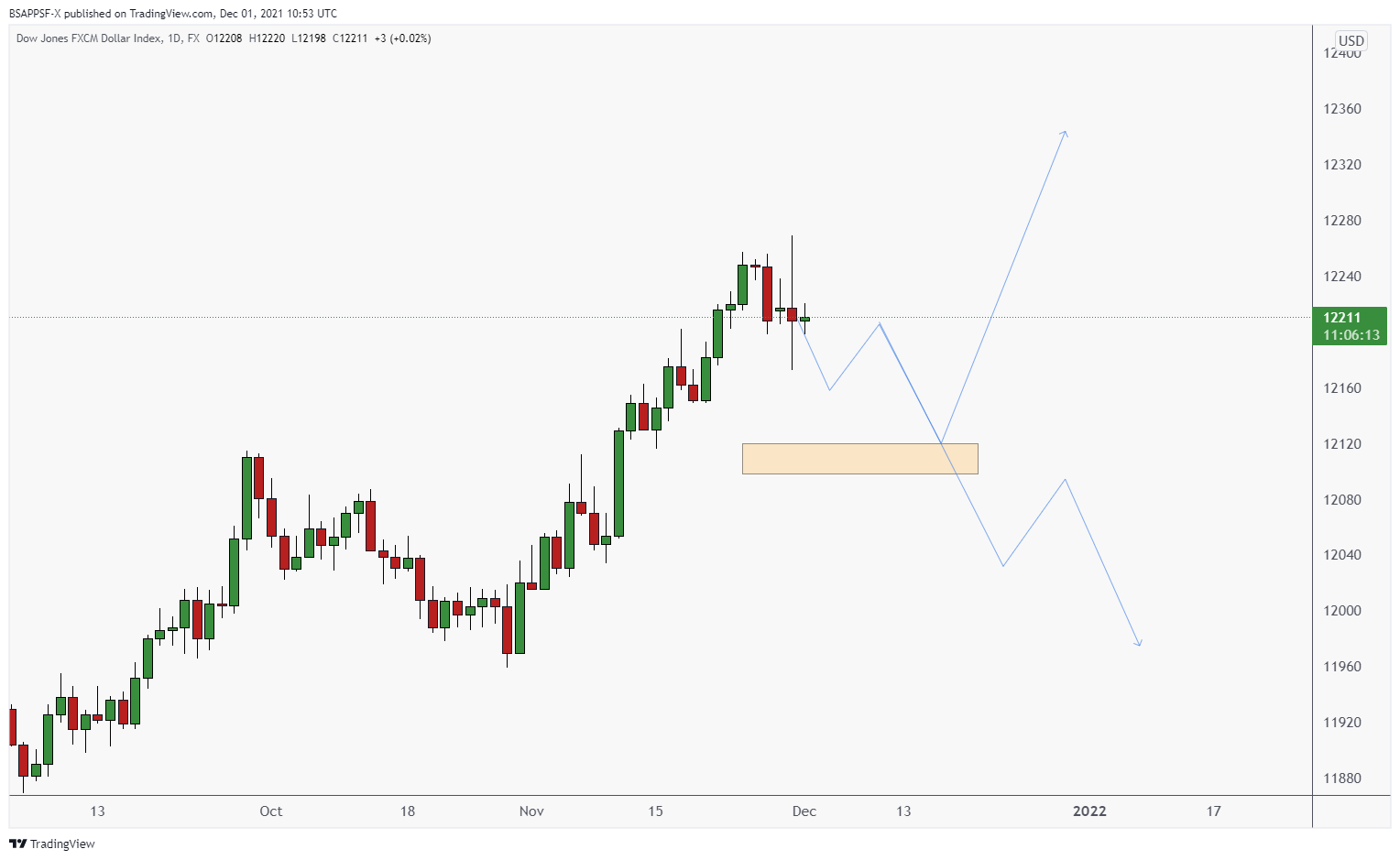

The dollar continued its push up last week – however we are starting to see the dollar start to pullback. We are anticipating for us to have a deeper pullback on the daily now. We may see the USDollar push down to 12100.

We saw some volatility yesterday around the FED’s comment on tapering earlier than previously anticipated. We may see some continued volatility today as the FED has more talks.

“At this point, the economy is very strong, and inflationary pressures are high.”

“It is therefore appropriate in my view to consider wrapping up the taper of our asset purchases, which we actually announced at our November meeting, perhaps a few months sooner.”

The Fed decided to cut its $120bn/month bond-buying stimulus programme by $15bn this month, and again in December. At that pace, the tapering would end in June. Powell, though, is signalling a faster taper – which could hurt asset prices, which have benefited from the Fed’s money-printing. (TheGuardian)

The new Omicron variant is causing global markets to move again, and we saw big moves on JPY and Indices last Friday off the back of this. I would assume that further volatility around this topic will continue, so we may see volatile moves across the board over the next few weeks.

Upcoming fundamental releases we have are:

Wednesday, December 1st

- GBP, BoE’s Governor Bailey speech

- USD, ADP Employment Change (Nov)

- USD, Fed’s Chair Powell testifies

- USD, ISM Manufacturing PMI(Nov)

Thursday, December 2nd

- AUD, Trade Balance (MoM)(Oct)

Friday, December 3rd

- EUR, ECB’s President Lagarde speech

- EUR, Retail Sales (YoY)(Oct)

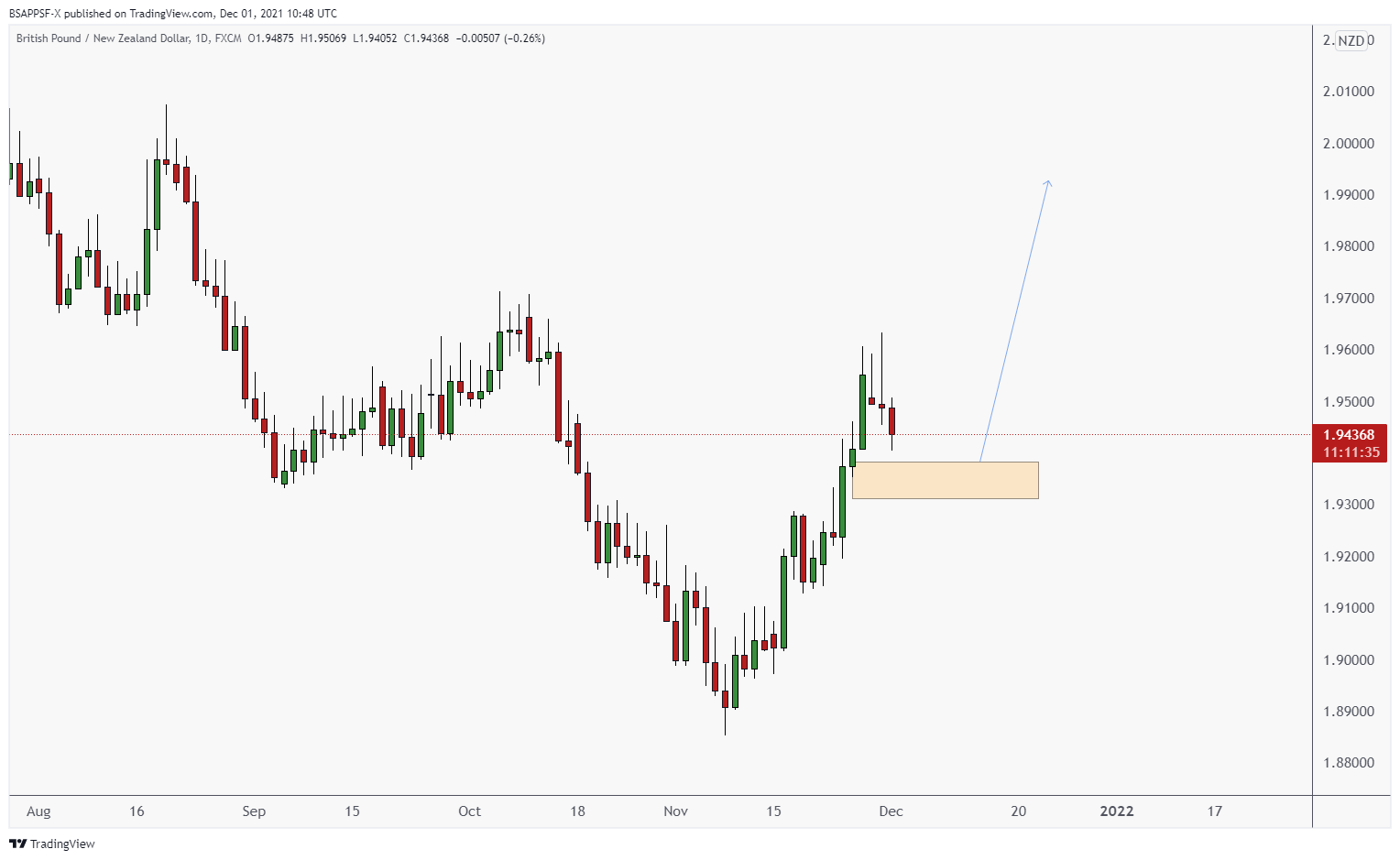

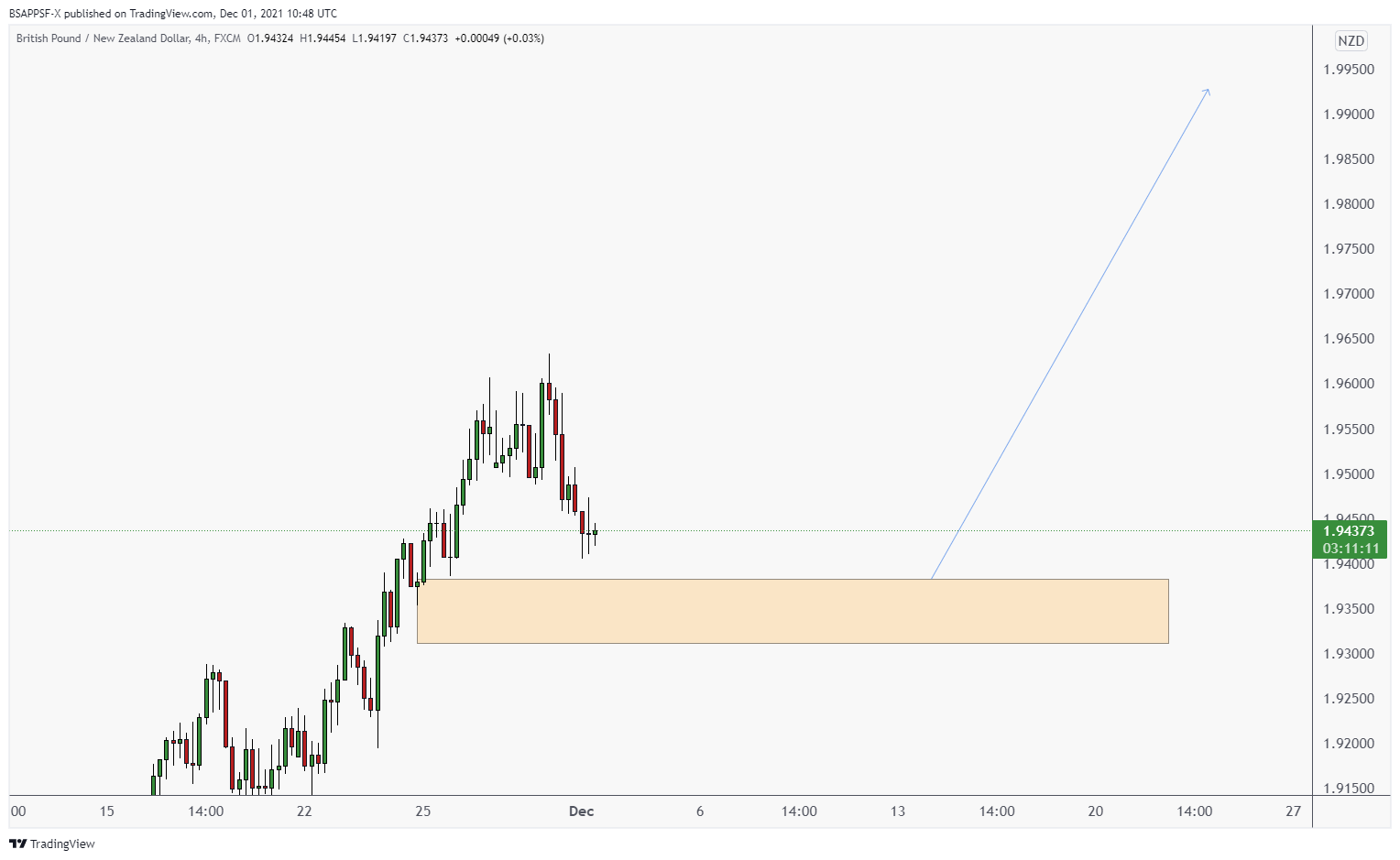

POTENTIAL SETUP: GBPNZD

We are watching GN for a long position. We will be monitoring PA around 1.935, and we will need to see strong reactions from here to get in. This is a really nice setup, so hopefully we can get an entry on it! We will be targeting around 1.98.