Currencies:

The dollar has continued its push up, with a lot of momentum this week. We have seen EUR/USD fall 160 pips and GBP/USD fall 300 pips off the back of this.

“Last week’s Fed meeting added fresh life into the debate about a potential hike in the fed funds rate in 2022,” said Jane Foley, head of FX strategy at Rabobank. “This is positive for the USD on two fronts. Firstly the USD looks better on a straightforward interest rate differential perspective. Secondly a hike in U.S. rates and a stronger USD will weigh on the growth outlook in emerging markets.” (Fxstreet)

We are looking for this dollar strength to continue, but we may start to see deep pullbacks across the board. We will be monitoring these pullbacks closely and will look to continue playing the dollars bullish trend.

Upcoming fundamental releases we have are:

Tuesday, October 5th

- AUD, Trade Balance (MoM)(Aug)

- AUD, RBA Interest Rate Decision

- AUD, RBA Rate Statement

- USD, ISM Services PMI(Sep)

Wednesday, October 6th

- NZD, RBNZ Rate Statement

- NZD, RBNZ Interest Rate Decision

- EUR, Retail Sales (YoY)(Aug)

- USD, ADP Employment Change(Sep)

Friday, October 8th

- USD, Nonfarm Payrolls(Sep)

- CAD, Unemployment Rate(Sep)

- CAD, Net Change in Employment(Sep)

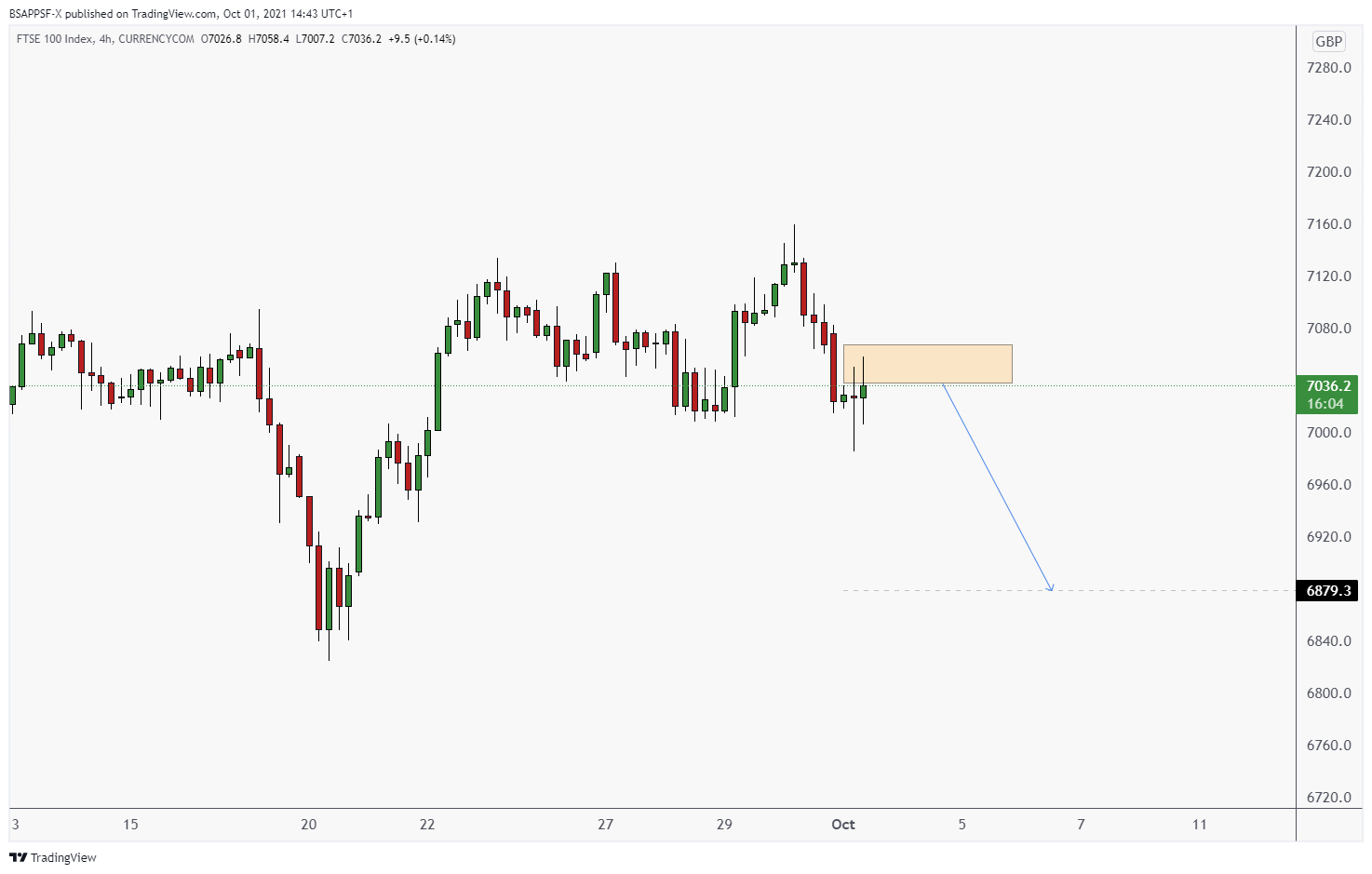

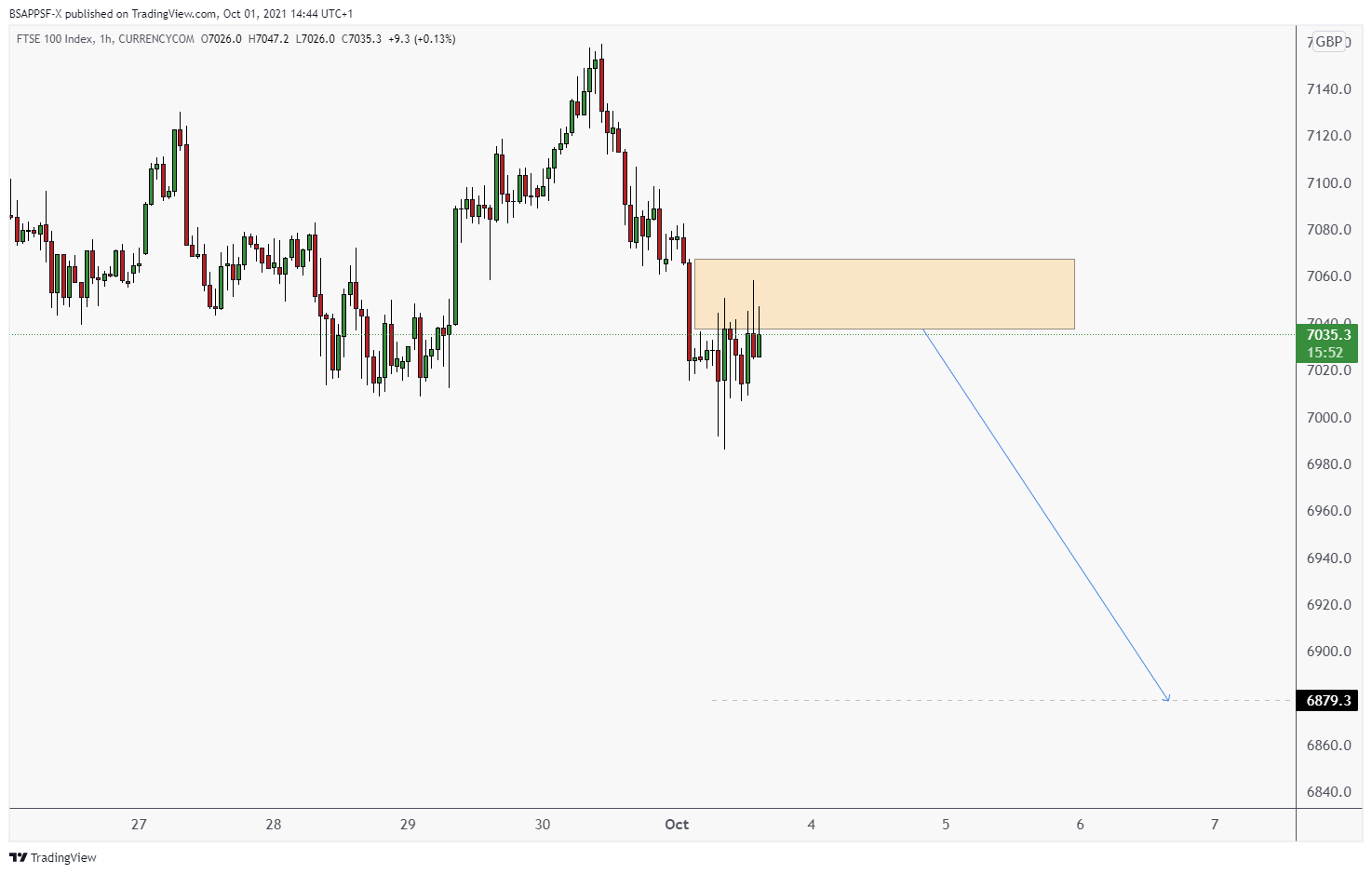

Potential Set Ups: UK100

UK100 – 4HR

UK100 – 1HR

We are watching UK100 (FTSE100) for a short position. This is more of an intraday style setup, the price action on the lower timeframe does look nice.