Currencies:

The Dollar has seen a strong push up this week, but we are anticipating a pullback from these levels. GBP/USD has hit a low 1.36, a 300 pip decline since hitting a high of 1.39 – 10 days ago. Although we are anticipating a pullback, for continued USD strength afterwards, we still need to push a little more before the bullish play is confirmed.

FOMC moved the markets yesterday, causing a spikes across the board. The US Federal Reserve’s updated Summary of Economic Projections revealed on Wednesday that half of the policymakers see a lift-off in the fed funds rate in 2022, compared to seven policymakers in June’s publication.

Earlier today the Bank of England’s (BoE) Monetary Policy Committee (MPC) released that they decided to leave the benchmark interest rate unchanged at 0.10% and kept the Asset Purchase Facility steady at £895 billion at the end of September policy meeting, as was widely expected. This has caused GBP strength to come into the market, after a week of taking a beating. We will have to monitor the £ pairs to see how they settle once the market digests this news.

Upcoming fundamental releases we have are:

Thursday, September 23rd

- CAD, Retail Sales (MoM) (Jul)

Monday, September 28th

- USD, Durable Goods (Aug)

- USD, Nondefense Capital Goods Orders ex Aircraft (Aug)

Tuesday, September 29th

- JPY, BoJ Monetary Policy Meeting Minutes

- AUD, Retail Sales s.a. (MoM) (Aug)

World Affairs: The Evergrande Group Crisis

Evergrande Group Crisis

This section will aim to cover high impact world affairs which could cause moves within the market.

Who/What is the Evergrande Group?

- Evergrande Group is one of China’s largest real estate developers

- It is the 122nd largest group in the world by revenue

- Employing about 200,000 people and it also indirectly helps sustain more than 3.8 million jobs each year

- They have also invested a lot into other things such as electric cars, football teams, theme parks and more

What has caused the ‘The Evergrande Group Crisis’?

- Company has been taking loans over the last few years, and the company is finding it hard to keep up with the repayments

- They have over $300bn of liabilities, a 6.5% market share of Chinese property market liabilities

- A few weeks ago they told investors they had cash-flow issues, and said it could default if unable to raise capital quickly

- Due to undertaking other capital intensive activities with aggressive ambitions it has caused a reduction in free cash-flow. Mattie Bekink, China director of the Economist Intelligence Unit stated, “strayed far from its core business, which is part of how it got into this mess.”

- Mark Williams, Capital Economics’ chief Asia economist stated that “Evergrande’s collapse would be the biggest test that China’s financial system has faced in years.” He further stated, “The root of Evergrande’s troubles and those of other highly-leveraged developers is that residential property demand in China is entering an era of sustained decline. Evergrande’s ongoing collapse has focused attention on the impact a wave of property developer defaults would have on China’s growth.”

What is happening now?

- They have brought on financial advisors to find a solution. They have a total of $669 million to be paid by the end of the year alone which they must try find the cash for

- Talks about either restructuring the company or an all out liquidation

Affect on the markets

- Companies stock has dropped 80% this year

- Hang Seng Index dropped 3.3%

- US Indicies fell between 1-2% across the board

- Cryptocurrency market cap fell 8.71%, with BTC falling 8.28%

Potential future consequences

- The main issue is the strain this will have on the banks in china, due to them needing their loans repayed. The ultimate consequence could be a credit-crunch scenario within China.

- This could be a catalyst for China to experience a economic downturn, and cause ripple affects around the world due to their influence in the global economy.

- Louis Tse, managing director at Wealthy Securities, a Hong Kong-based brokerage stated that “Evergrande is just the tip of the iceberg.” He added, “That affects the banks as well… if you have lower property prices what happens to their mortgages? It has a chain effect.”

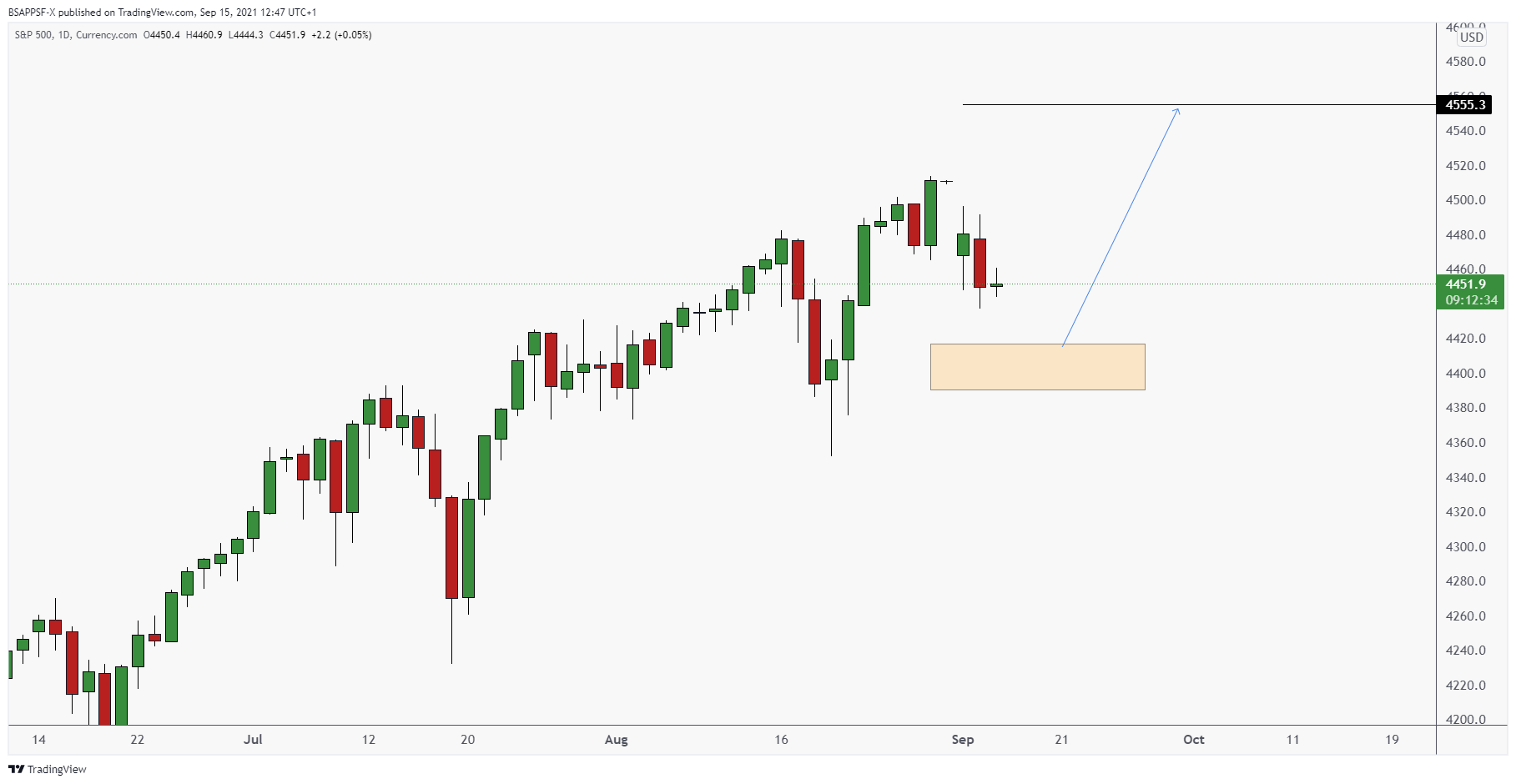

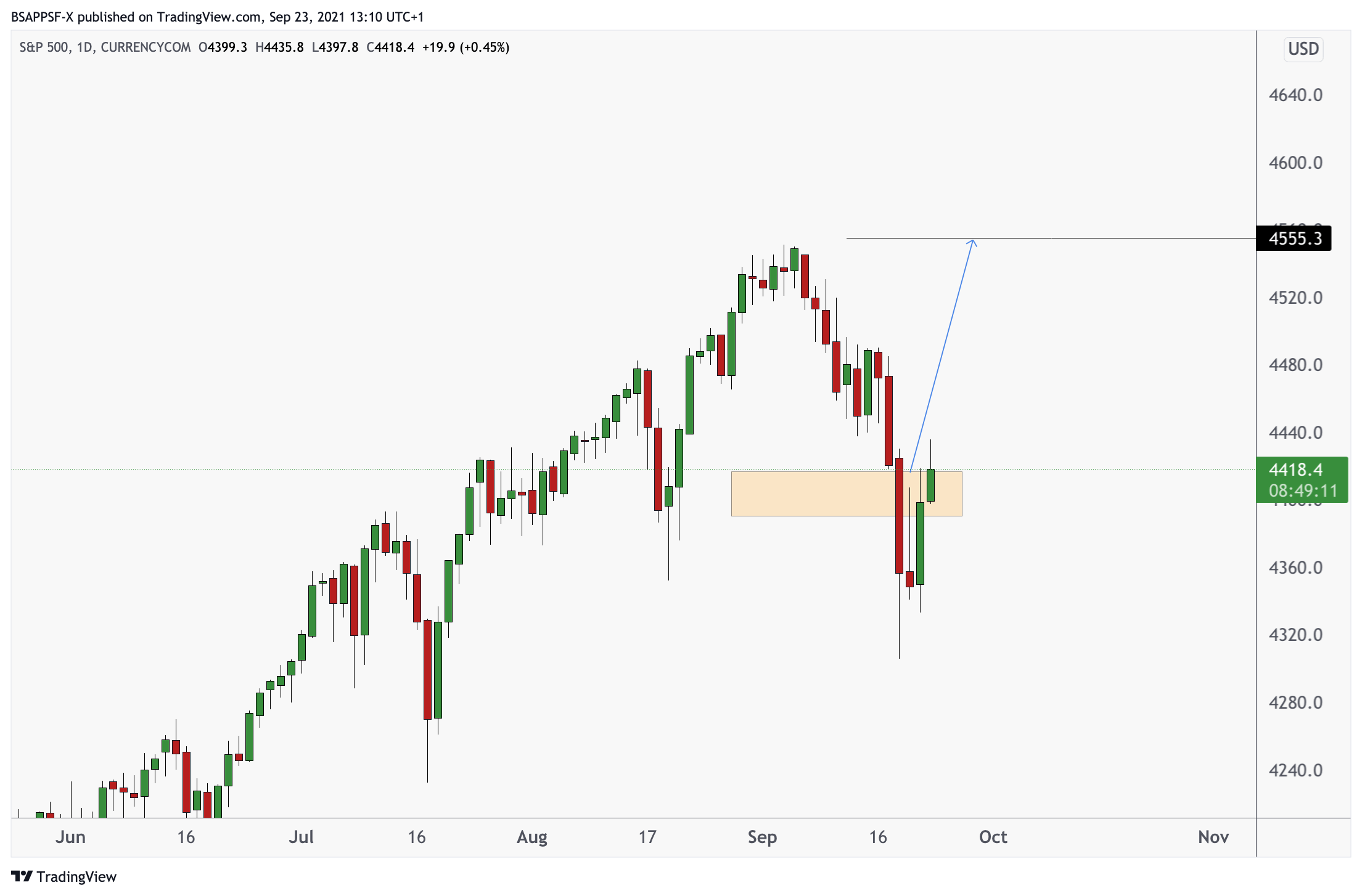

RECAP: Potential Set Ups: US500