Currencies:

Last week we mentioned that we were carefully watching the USD to see if it will break our area of interest or not. We have had confirmation that this level has been broken, off the back of poor NFP data pushing the dollar lower. We are now looking for continued weakness on the dollar and treating any pullback as reasons to sell this.

Here are some comments from the UOB Group’s Senior Economist Alvin Liew on the latest Nonfarm Payrolls figures:

“Job creation came in well below expectations in August for the US economy, with the surge of COVID-19 infections across US due to the Delta variant blamed for denting the recovery pace of the US labour market. In the latest report by the Bureau of Labor Statistics (BLS), the US nonfarm payrolls (NFP) rose by 235,000 jobs in Aug, a big miss from the Bloomberg median estimate of 725,000 jobs, while Jul jobs increase was revised higher to show 1.053 million more jobs created (versus 943,000 previously reported).”

“The unemployment rate expectedly eased further to 5.2% in Aug (from 5.4% in Jul), the lowest in 16 months, since the onset of the pandemic (Mar 2020). Nonetheless, the unemployment rate was still 1.7ppts above the low of 3.5% recorded in Jan and Feb of 2020. The dip in unemployment rate was amidst the 235,000 jobs print and a steady participation rate of 61.7% in Aug (same as Jul).”

Due to the dollar breaking out to the downside, we have now changed our bias’s on a few currencies. We are now looking for continued longs AUD and NZD pairs, AUD/USD, GBP/AUD, AUD/JPY, NZD/USD and NZD/JPY are the ones we are watching closely.

Upcoming fundamental releases we have are:

Wednesday, September 8th

- JPY, Gross Domestic Product (QoQ) (Q2)

- CAD, BoC Rate Statement

- CAD, BoC Interest Rate Decision

Thursday, September 9th

- EUR, ECB Interest Rate Decision

- EUR, ECB Monetary Policy Decision Statement

- EUR, ECB Deposit Rate Decision

- EUR, ECB Press Conference

- CAD, BoC’s Governor Macklem speech

Friday, September 10th

- EUR, Harmonized Index of Consumer Prices (YoY)(Aug)

- EUR, ECB’s President Lagarde speech

- CAD, Unemployment Rate(Aug)

- CAD, Net Change in Employment(Aug)

Make sure you pay attention to the @bsappsfxltd Instagram page, as this will provide you with the upcoming fundamental releases at the beginning of the week as well as other valuable information and insights!

Cryptocurrencies

Bitcoin has managed to breach the $50k level after some consolidation. This is a significant price point for BTC, and further upside is expected. ETH has also managed to hit $4k for the first time since May. This again is a significant price point and both BTC and ETH are not far off ATH. Other ALT’s have also been pumping, with IOTA pushing up 120% in just 3 days! It would be nice to see this continue to push up, but of course with cryptos we have to be extremely careful with how we trade/invest into it due to the unpredictable nature of it, as seen in May earlier this year. The overall sentiment around cryptos right now is very bullish.

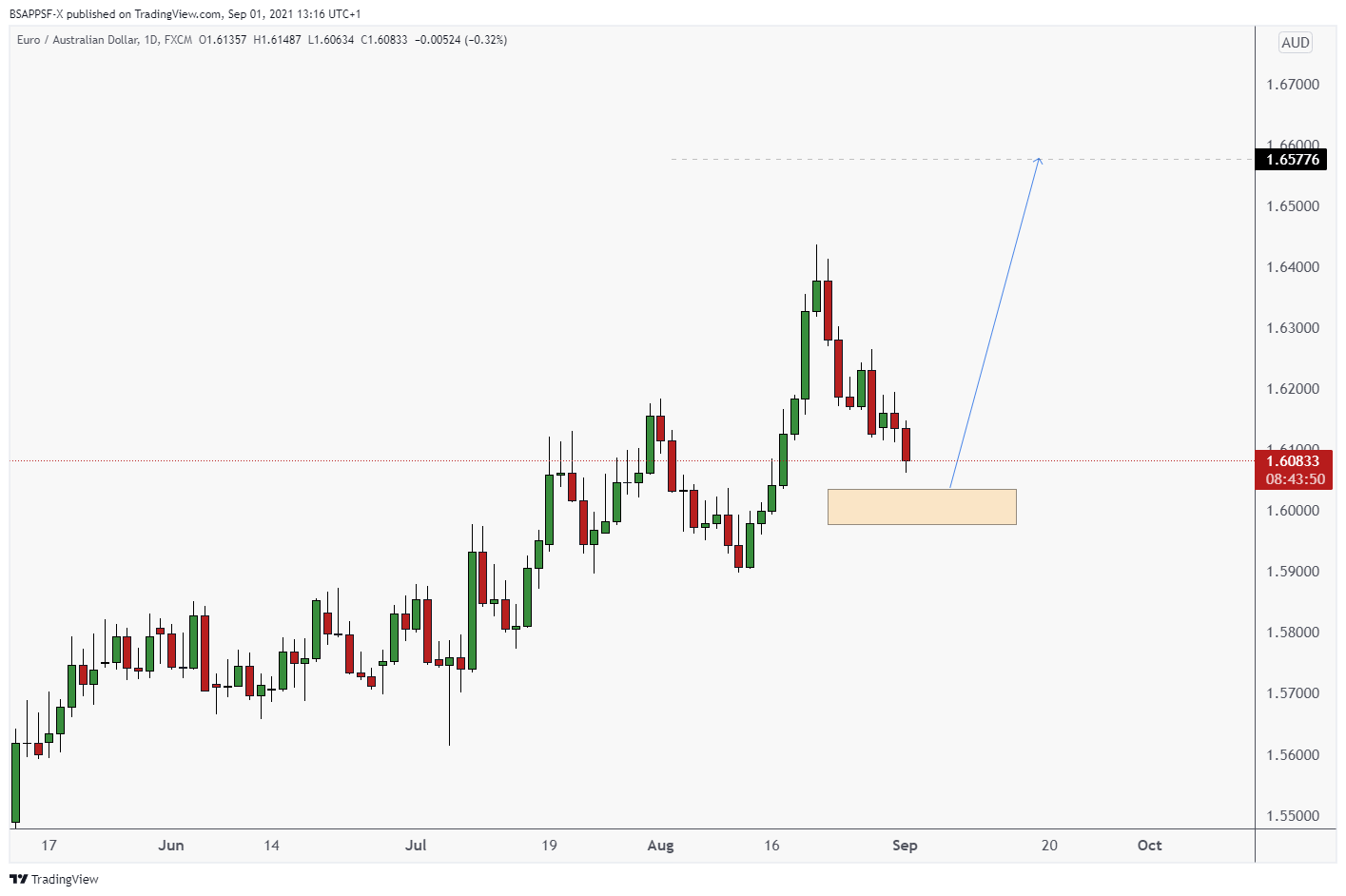

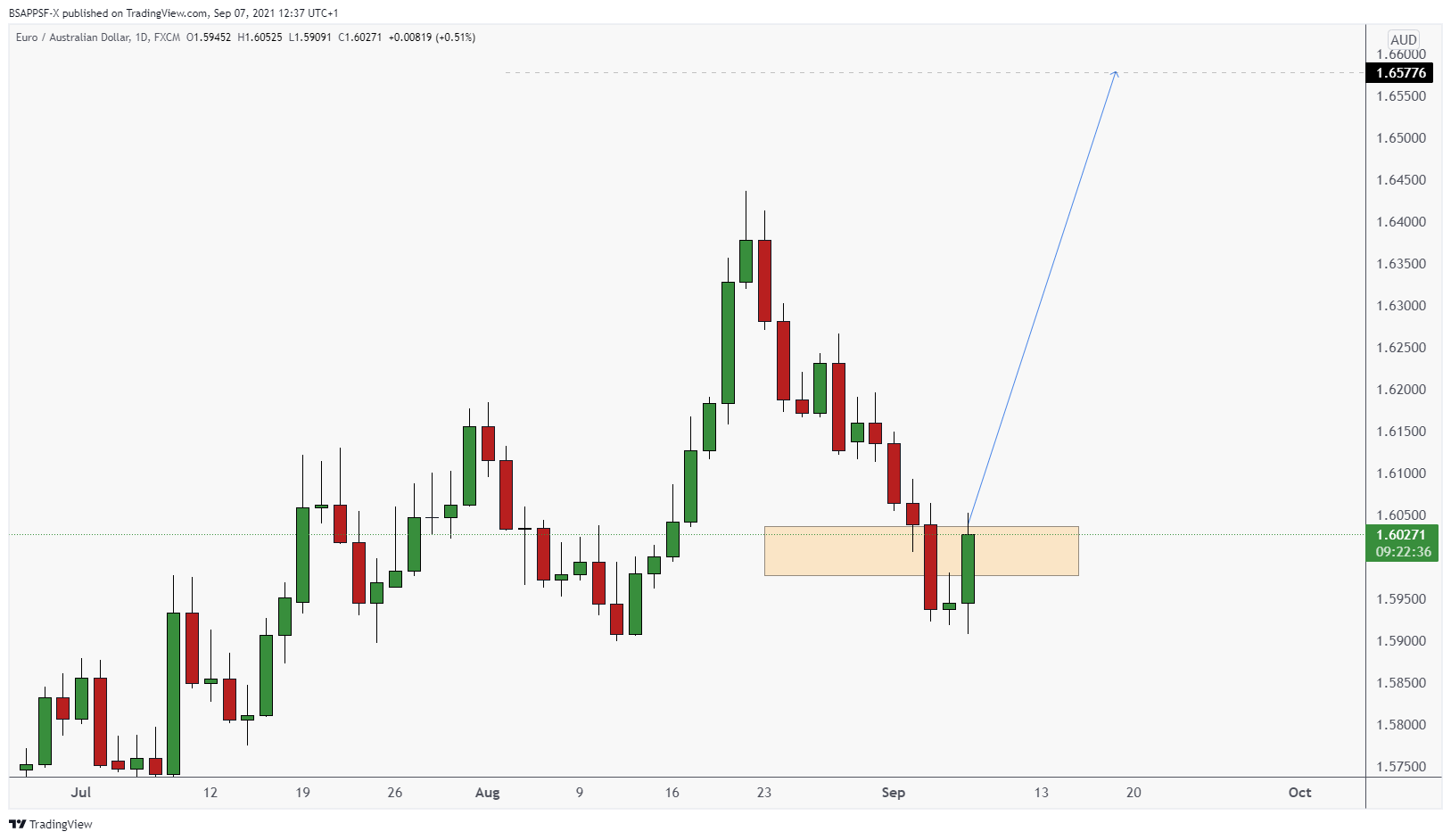

RECAP – Potential Set Ups: EUR/AUD

EURAUD – Daily

EURAUD – Daily (posted in the previous blog post)

Last week we said we were watching EUR/AUD for a long position. However, we mentioned that you need to be weary of the AUD strength we were seeing, and we would have to see some convincing price action on the lower timeframe to get involved. Unfortunately, we didn’t see the reaction we wanted to, and therefore we did not execute this setup.

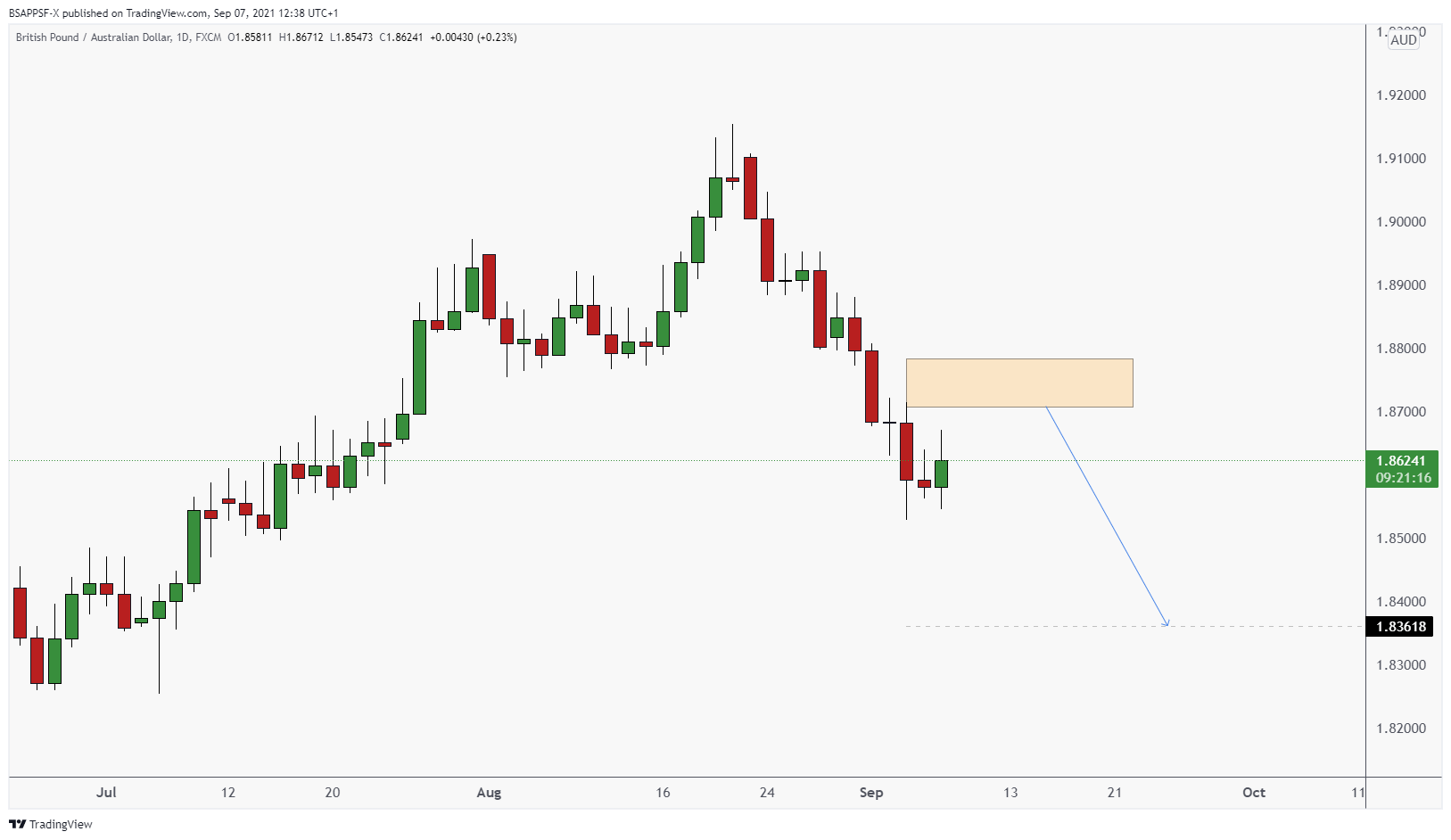

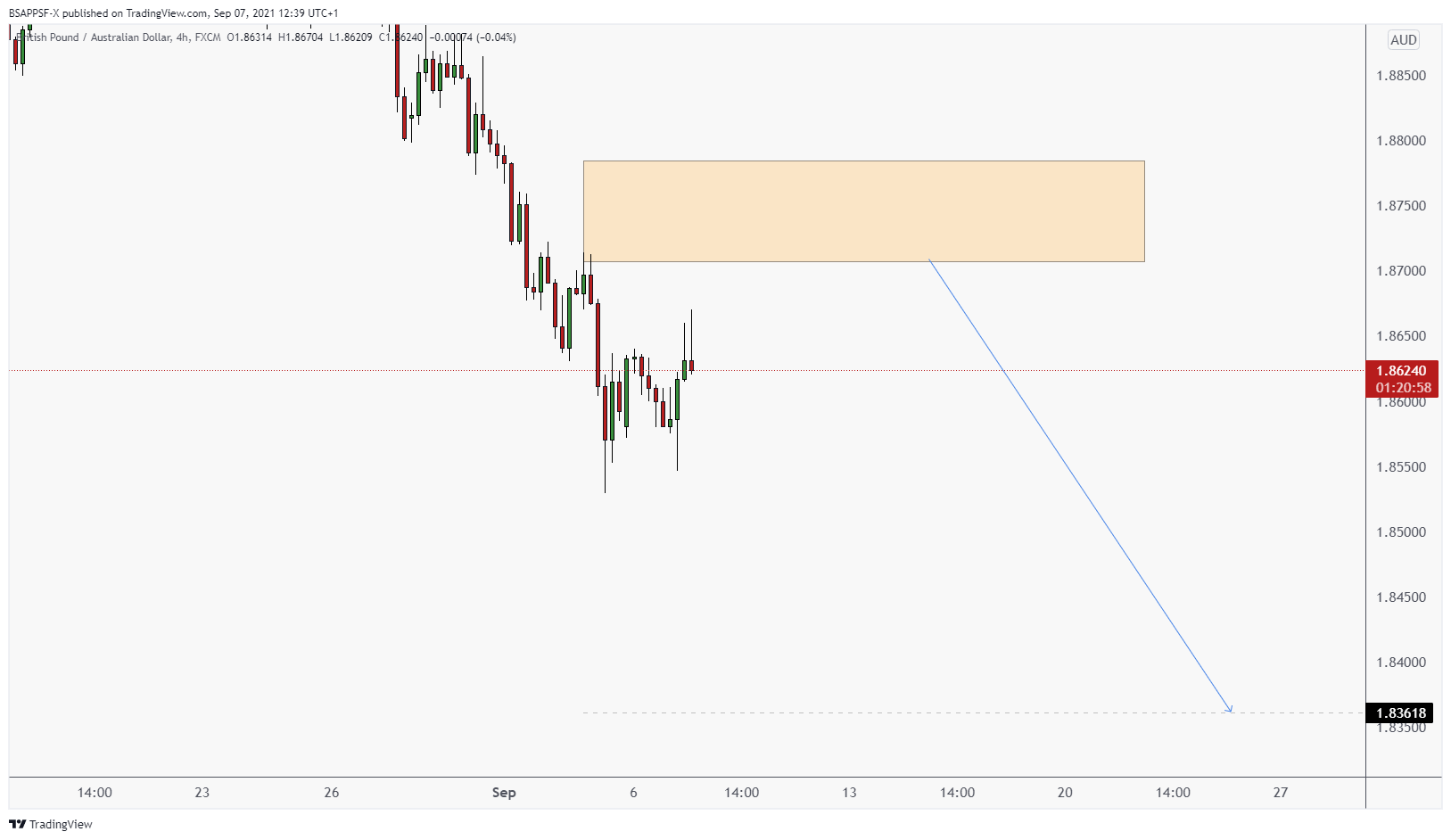

Potential Set Ups: GBP/AUD

GBPAUD- Daily

GBPAUD – 4HR

We are watching GBP/AUD for a short position. We will need to monitor price action at the area of interest before we execute the position. If we do execute the position, we will be targeting 1.83618.

Written by Aqil – Head Analyst