Currencies:

The USD saw a massive push up on Thursday and Friday last week. This was off the back of the FOMC release. A hawkish surprise from the Federal Reserve, with the main takeaway being that they have shifted towards two rate hikes in 2023 from a previous of zero. Expectations heading into the release had been a 50/50 call that the Fed would shift to only one rate hike in 2023.

In the previous blog post, we mentioned that we were looking for longs on the dollar – and ultimately, we saw big moves across the board. EUR/USD was a pair mentioned in last weeks blog post. We said that we were looking for any pullbacks, in line with our strategy, to look for a short position. A really clean setup did develop and ultimately fell nearly 300 pips from our area of interest!

We are looking for this bullish movement to continue on the dollar. We are however looking for pullbacks to get involved in these trades. Since the market open, we have seen the dollar pullback. We are watching to see if this pullback can continue, but we will be monitoring price action closely across the board to see if we begin to see the bullish dollar step back in.

Upcoming fundamental releases we have are:

Tuesday 22nd June

- USD, Fed’s Chair Powell testifies

Wednesday 23rd June

- JPY, BoJ Monetary Policy Meeting Minutes

- EUR, Markit Manufacturing PMI (Jun)

- EUR, Markit PMI Composite (Jun)

- GBP, Markit Services PMI (Jun)

- CAD, Retail Sales (MoM) (Apr)

- EUR, ECB’s President Lagarde speech

Thursday 24th June

- EUR, European Council Meeting

- JPY, BoJ’s Governor Kuroda speech

Make sure you pay attention to the @bsappsfxltd Instagram page, as this will provide you with the upcoming fundamental releases at the beginning of the week as well as other valuable information and insights!

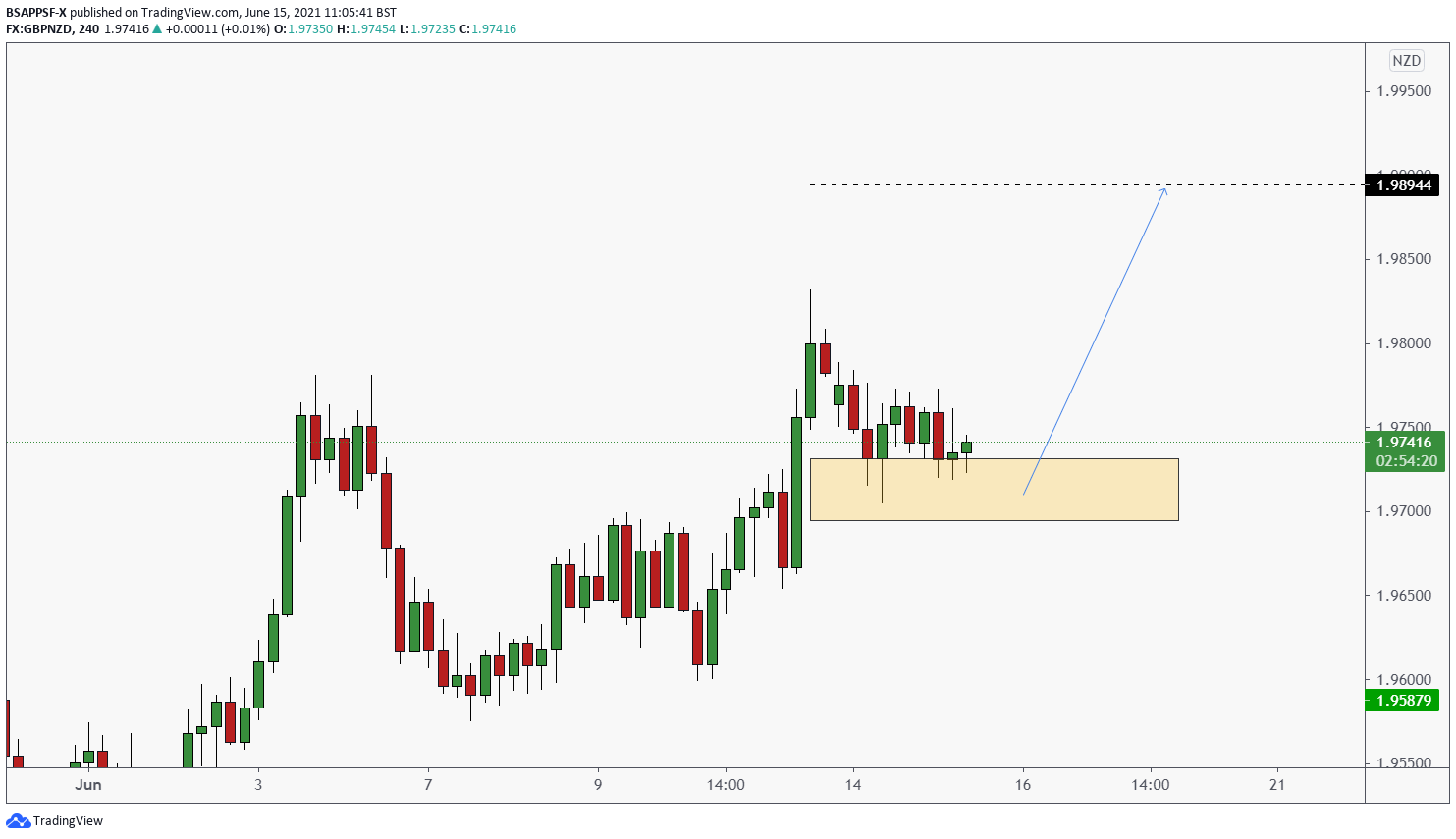

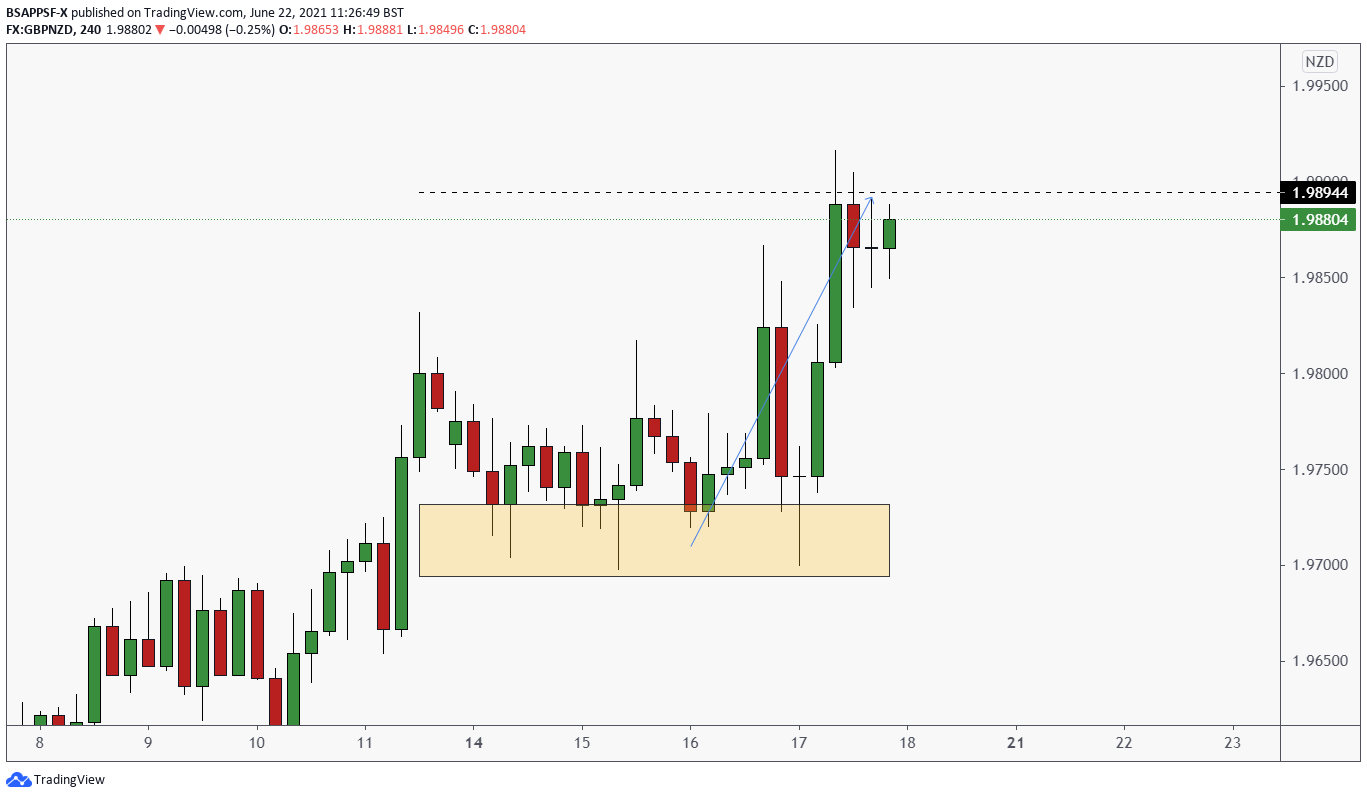

RECAP: Potential Set Ups: GBP/NZD

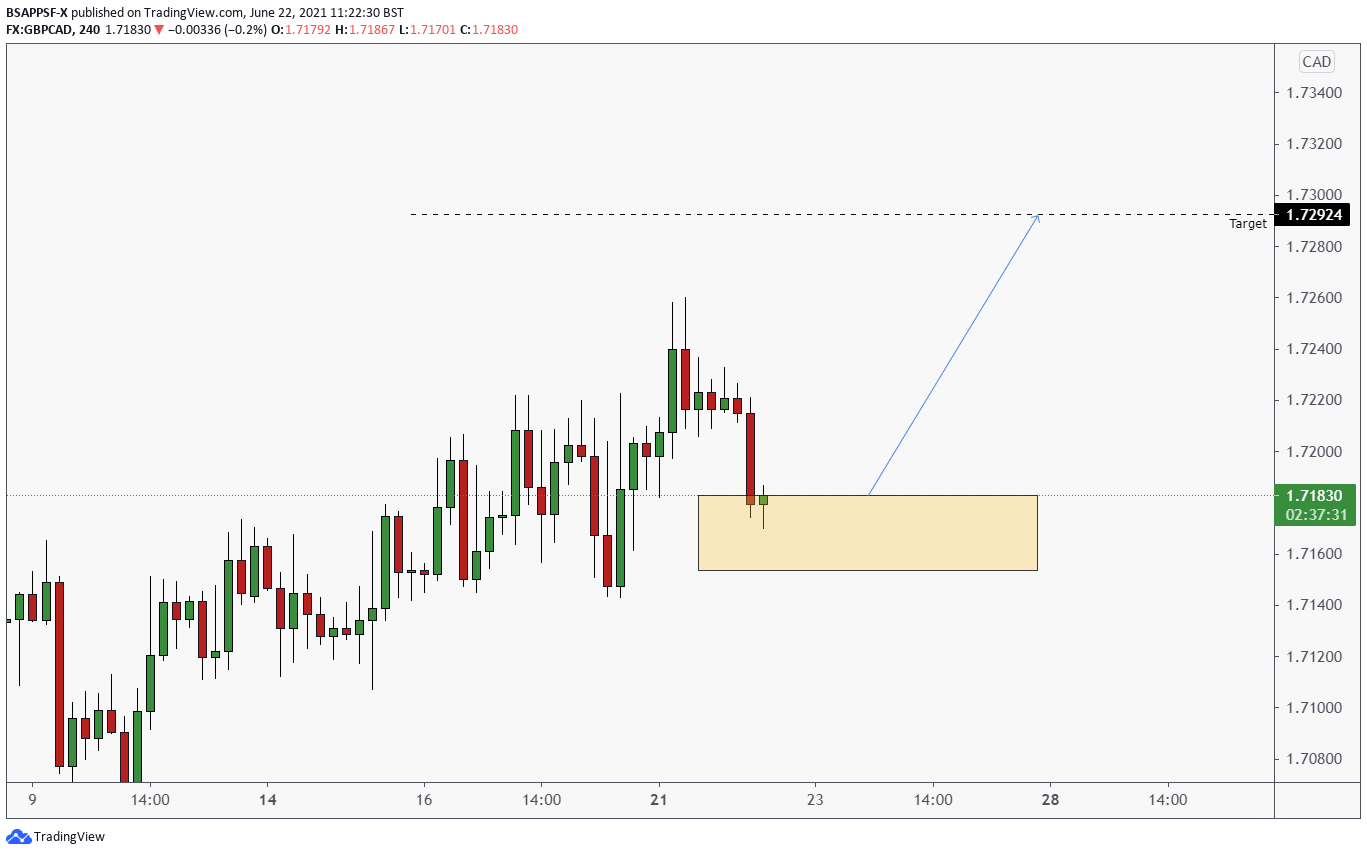

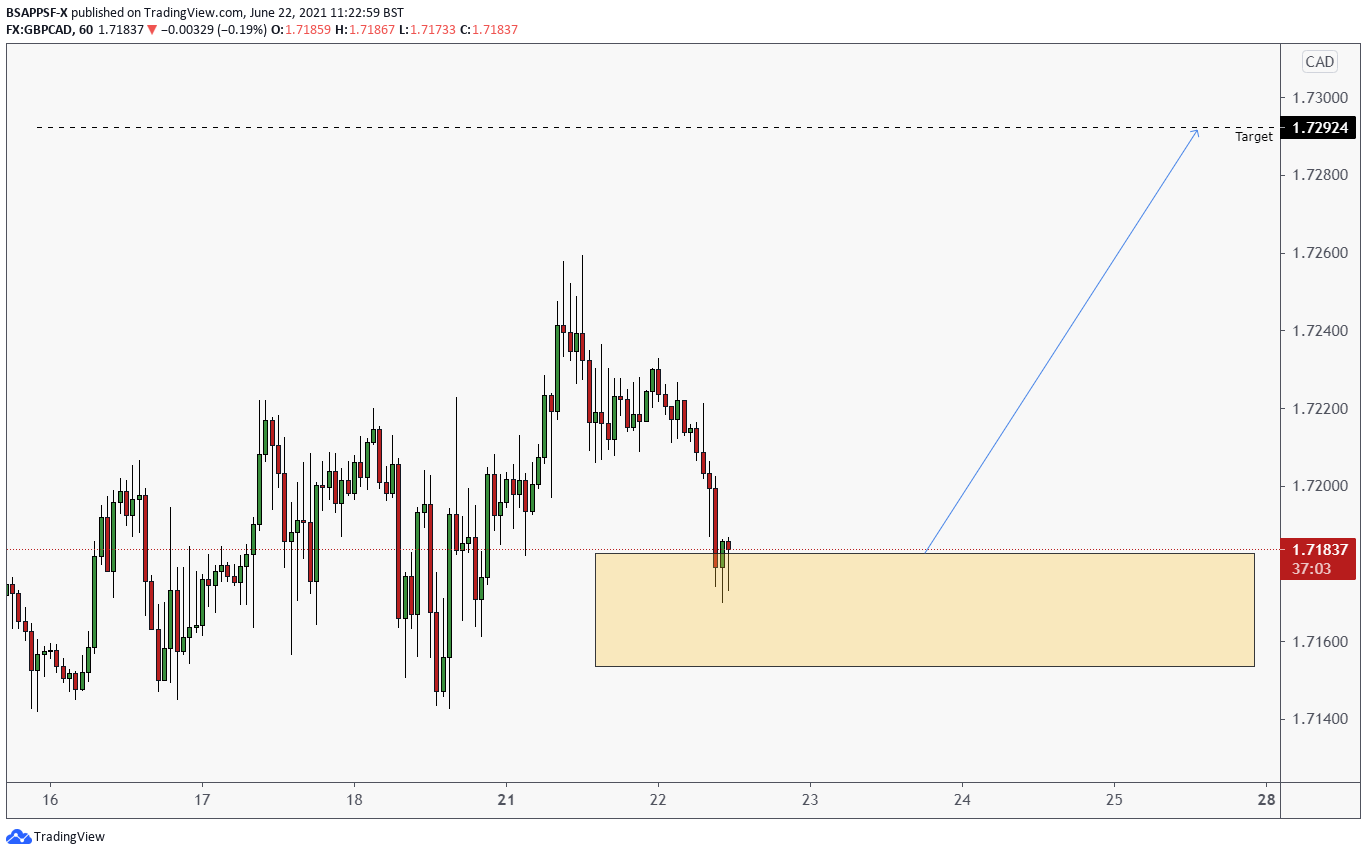

Potential Set Ups: GBP/CAD