Currencies:

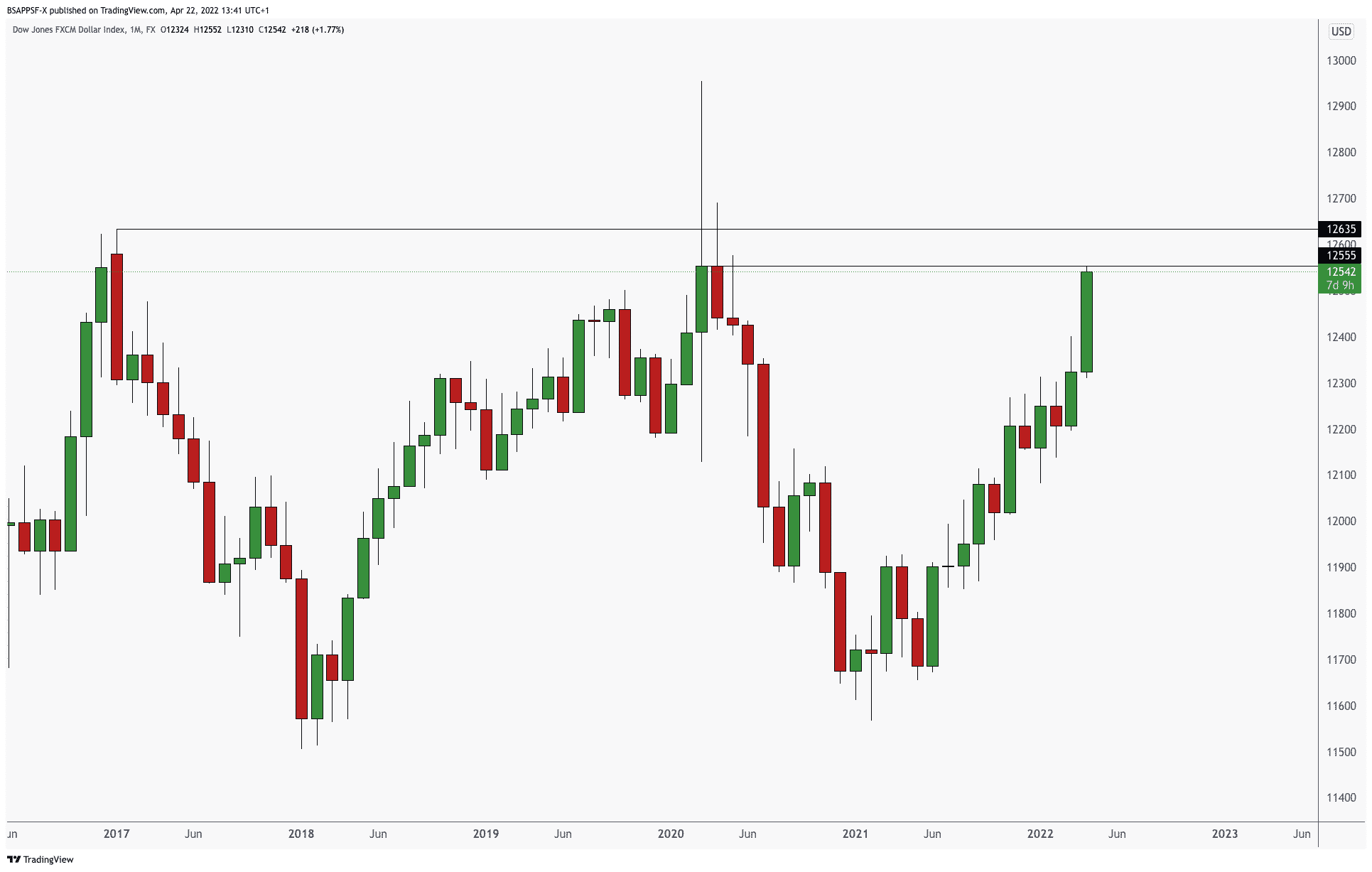

The USDollar has continued its bullish run up, making new highs. This was anticipated as structure remained bullish, so any pullback was a reason to buy this – as highlighted in the previous post.

We are however pushing up into a monthly are where price has rejected the previous two times. Because of this, I am anticipating some type of reaction around this price level (see image below). We will remain bullish of course, but just be aware that price could react from here.

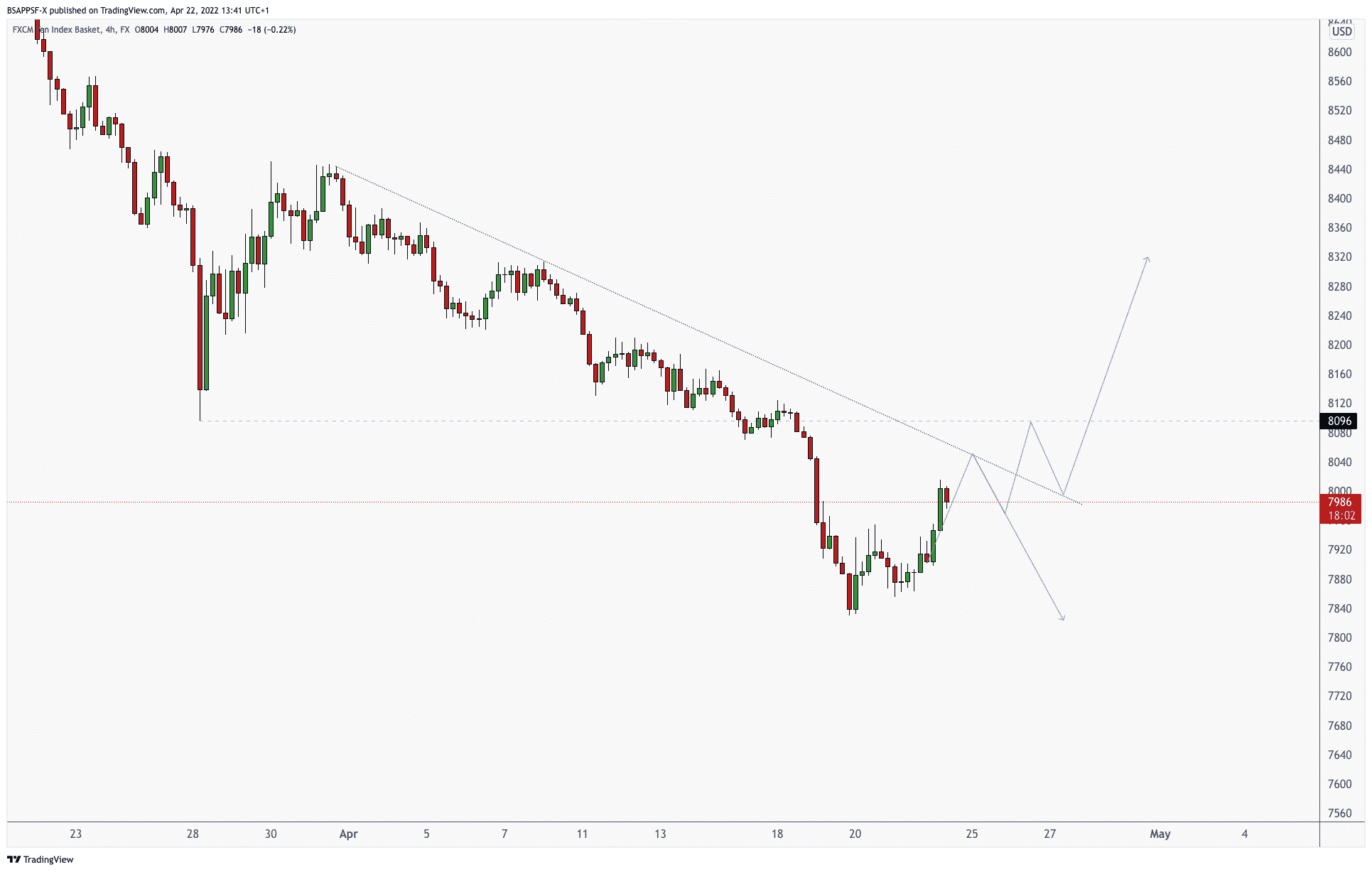

The JPY has continued its melt off over the last 10 days – but we are now seeing some relief. We have multiple more levels to break before upside is confirmed, but it could be something to watch out for. The pullback on this will be huge, especially if the fundamentals around the JPY rate decision changes over the coming weeks. It is still very bearish, so continued shorts make the most sense – just be aware that things could change very quickly and getting caught on the other side could cause some damage. Especially if the change happens over the weekend – gaps would be insane.

GBP has had a big push down today, off the back of the PMI data release.

- UK Manufacturing PMI rises to 55.3 in April

- Services PMI in the UK comes in at 58.3 in April, misses estimates.

‘The slowest rise in UK private sector output for three months in April puts the BOE in a tricky position, exacerbating the pain in the GBP.’

Upcoming fundamental releases we have are:

FRIDAY, APRIL 22nd

- EUR, ECB’s President Lagarde speech

- GBP, BoE’s Governor Bailey speech

SUNDAY, APRIL 24th

- EUR, French Presidential Election

MONDAY, APRIL 25th

- CAD, BoC’s Governor Macklem speech

TUESDAY, APRIL 26th

- USD, Durable Goods Orders(Mar)

- USD, Nondefense Capital Goods Orders ex Aircraft(Mar)

WEDNESDAY, APRIL 27th

- AUD, Consumer Price Index (QoQ)(Q1)

- AUD, RBA Trimmed Mean CPI (QoQ)(Q1)

USDollar Monthly

JPYBasket – 4HR

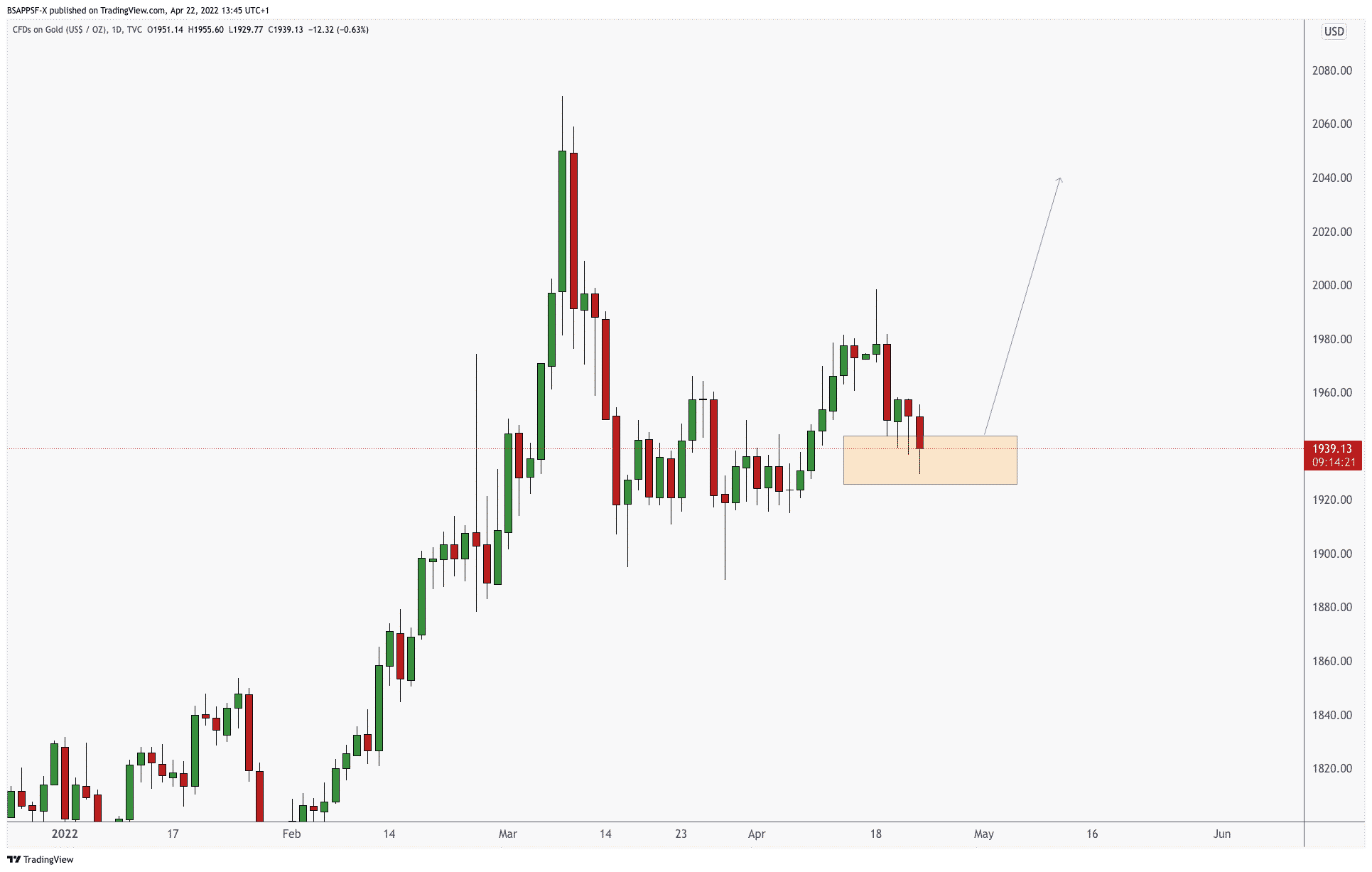

Potential Setups

Here are a few setups we will be keeping our eyes on.

Written by Aqil – Head Analyst