Currencies:

This week we experienced some big gaps across the board, with pairs such as EURUSD hitting over 135 pips! This was caused by on-going conflict over the weekend – this week be weary we could see gaps again.

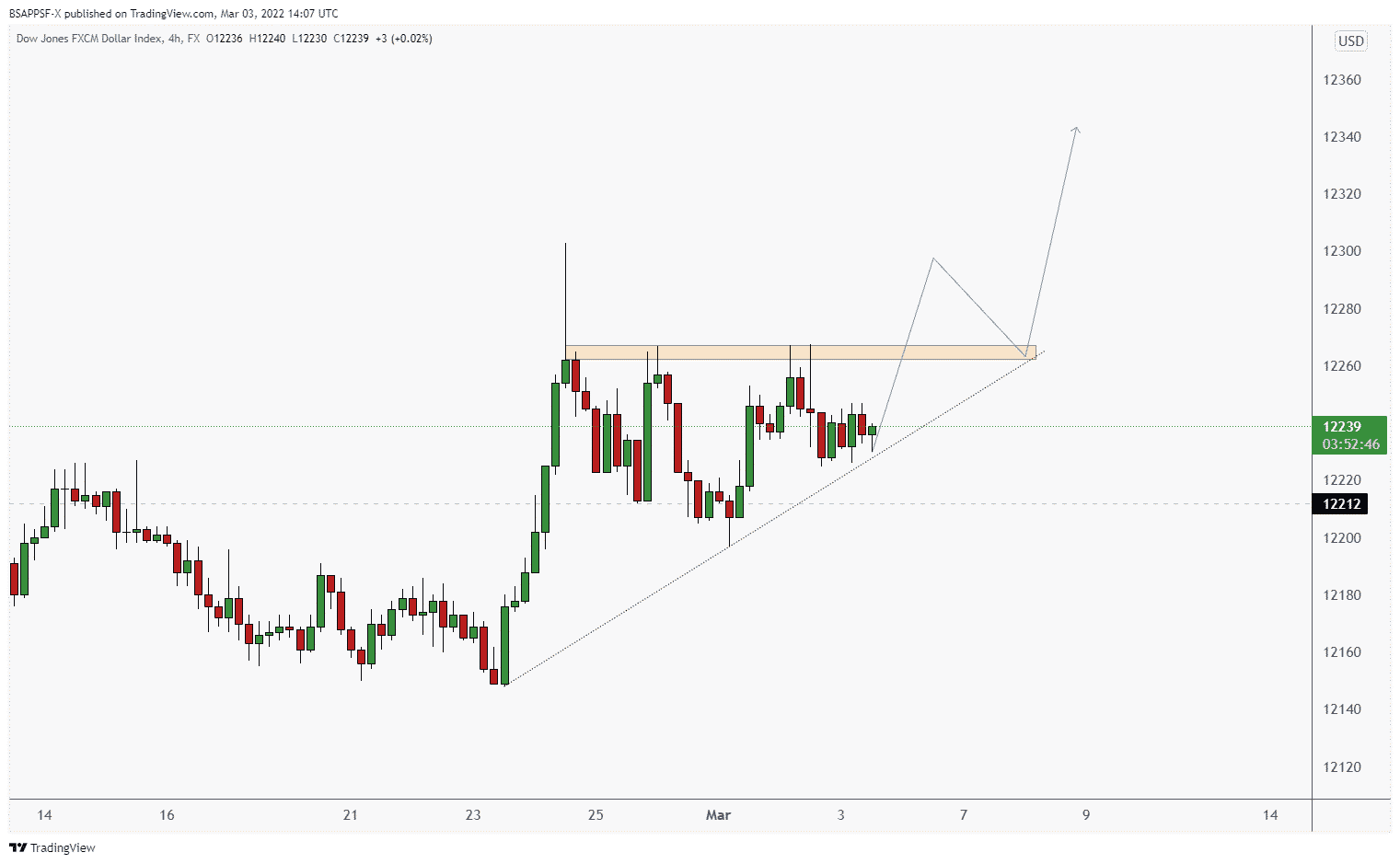

The dollar is still looking bullish when looking at the USDOLLAR basket. However, when we look across the board the bias is a little mixed. Pairs such as AUDUSD, NZDUSD, USDCAD are showing dollar weakness but others such as GBPUSD, EURUSD, USDJPY are showing dollar strength. My bias is still bullish when looking just at the technicals, but these correlations being a little mixed is something to be thinking of.

The ongoing conflict in Russia it can be hard to keep ontop of developments. This is a great resource to check to see what are the latest updates on it: https://www.fxstreet.com/events/special-coverage

Upcoming fundamental releases we have are:

Thursday, March 3rd

- USD, Fed’s Chair Powell testifies

- USD, ISM Services PMI (Feb)

- CAD, BoC’s Governor Macklem speech

- CAD, BoC’s Governor Macklem speech

Friday, March 3rd

- EUR, ECB’s President Lagarde speech

- USD, Durable Goods Orders (Jan)

- USD, Nondefense Capital Goods Orders ex Aircraft (Jan)

Monday, March 5th

- EUR, Retail Sales (YoY) (Jan)

- USD, Nonfarm Payrolls (Feb)

- CHF, Gross Domestic Product s.a. (QoQ) (Q4)

USDollar 4HR

USDollar Daily

Potential Setup – CADJPY

CADJPY is on the watchlist this week for longs. We have seen a nice breakout on the daily, so it makes sense to look to continue this trend up. 91.00 is the AOI where I am expecting a reaction. Like all setups, we need to wait for price to reject this AOI before we look to get involved with this i.e. 1HR/4HR Engulfing. 92.70 is our target for this setup.

CADJPY – Daily

CADJPY – 4HR

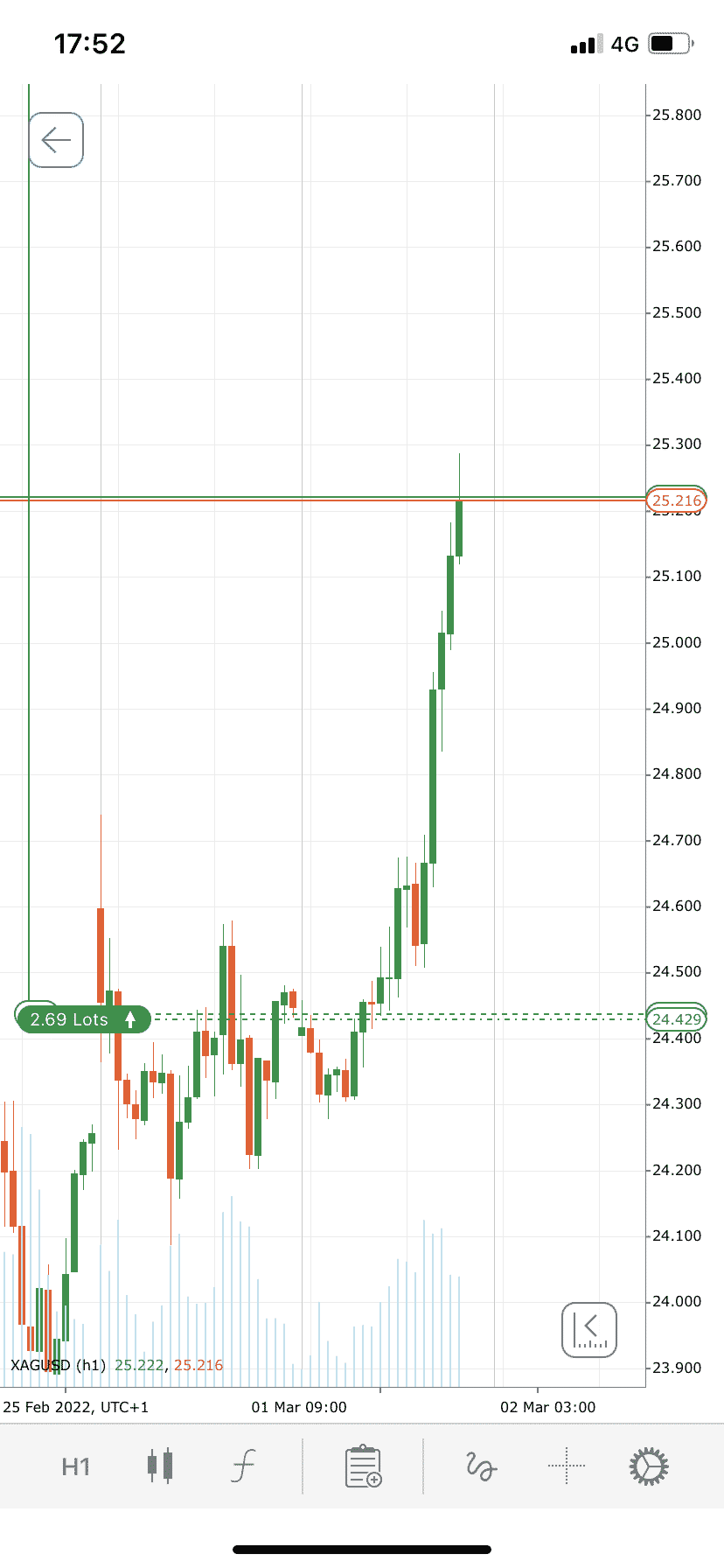

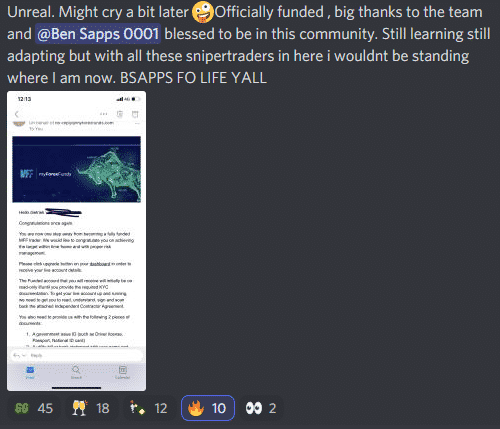

Group Wins:

Our Advance group has been smashing it recently despite tricky conditions, below are just a handful of the wins shared within the group.

Written by Aqil – Head Analyst