Currencies:

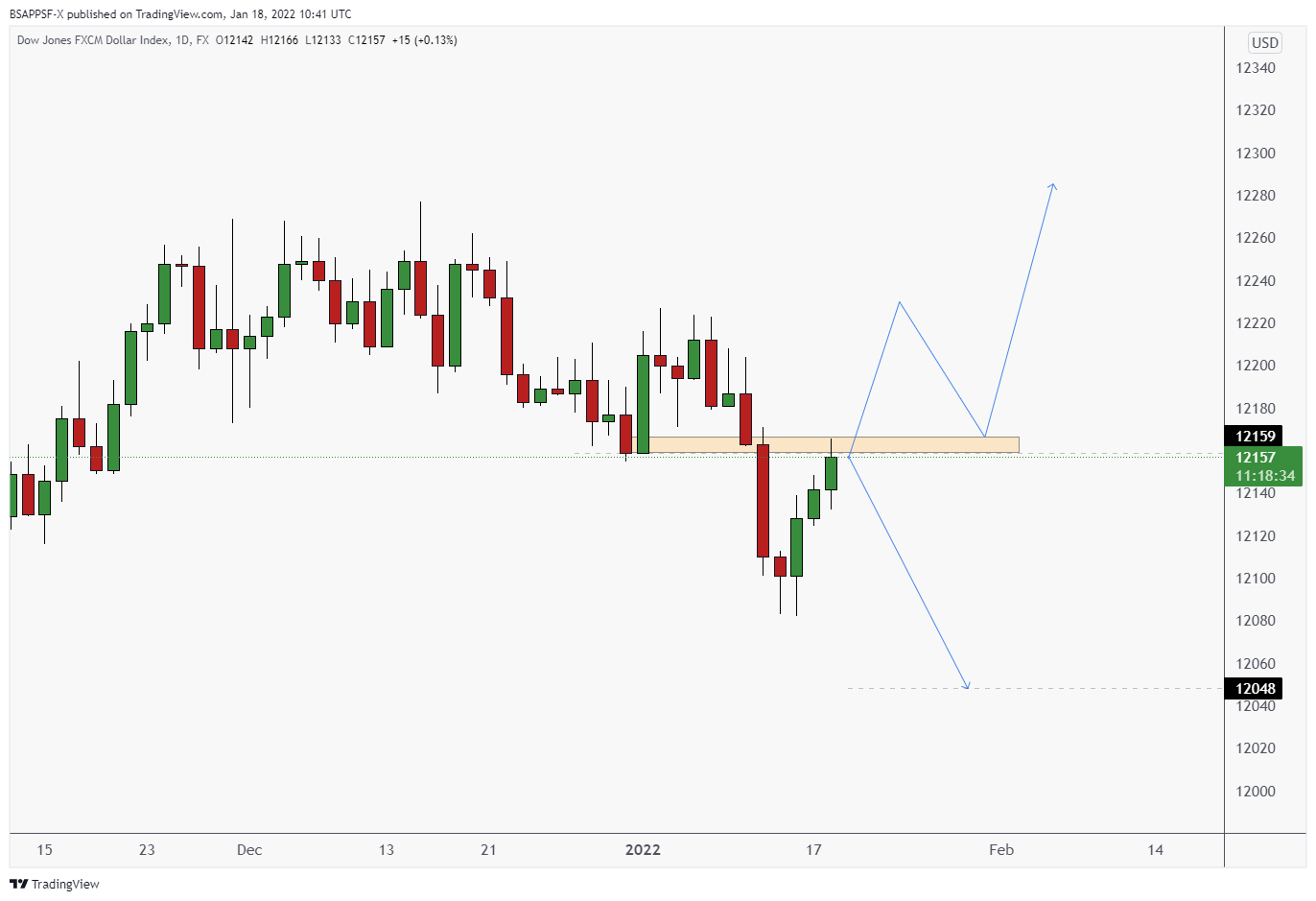

We have seen the push down on the dollar as we anticipated, and we are still watching this for more downside. We are now at an interesting level where we are anticipating a reaction from 12160. We are seeing a slow down here right now, but we will need to wait for some more confirmation on the 4HR to confirm we are reacting from this AOI. If the dollar does breakout to the upside, then we can simply wait for the retest to take it long.

Our general biases for currencies:

USD: Down

EUR: Up

GBP: Up (needs pullbacks though)

AUD: Down

NZD: Down

CAD: Up

JPY: Mixed

Our overall biases are still the same as last week. We are starting to see pullbacks on the GBP pairs which is nice, so we may see some setups form on these soon.

Upcoming fundamental releases we have are:

Wednesday, January 19th

- GBP, Consumer Price Index (YoY)(Dec)

- EUR, Harmonized Index of Consumer Prices (YoY)(Dec)

- CAD, BoC Consumer Price Index Core (YoY)(Dec)

- GBP, BoE’s Governor Bailey speech

Friday, January 20th

- AUD, Employment Change s.a.(Dec)

- AUD, Unemployment Rate s.a.(Dec)

- CNY, PBoC Interest Rate Decision

Fundamentals:

The Bank of Japan raised its inflation forecasts last night but said it was in no rush to change its ‘ultra-loose monetary policy’. Governor Haruhiko Kuroda acknowledged that price pressures were rising, but said the central bank had no intention of raising interest rates with inflation projected to stay below its 2% goal for the next few years.

Current inflation forecast for Q1 is 1.1%, up from 0.9% previously. This is a lot lower than most other economies such as the US – where inflation has hit 7%.

Inflation has a big impact on currencies over the long run, the book recommended in a previous blog post (The creature from Jekyll Island by G. Edward Griffin) talks about this impact and the steps economies take to combat it.

Potential Setup – EURUSD

EURUSD Daily

EURUSD 4HR

We are watching EURUSD closely for a long position. This fits in well with our bias for dollar downside overall. We will need to watching price action on the 1HR and 4HR and wait for strong candle rejections before getting involved.

Written by Aqil – Head Analyst