Currencies:

The Dollar has had a nice push up, straight from our 4HR AOI shared last week. We are looking to continue this bullish trend going up. We still have the ongoing conflict in Ukraine which can move the market so be weary of any significant developments with this. As you can see on the USDOLLAR chart, we are looking for continued longs on any pullback right now.

Today we have had CAD CPI data out. Canadian inflation hit 5.7% YoY in February, according to Statistics Canada’s latest headline Consumer Price Index release. That was above the expected rise to 5.5% from 5.1% in January.

We have also had US Retail sales out. Retail Sales in the US rose by 0.3% on a monthly basis in February to $658.1 billion. This fell short of the market expectation for an increase of 0.4%. We have not seen any major reaction within the market to this.

We still have a lot of fundamentals out over the next couple of days, so stay sharp in case we see some volatile moves.

Upcoming fundamental releases we have are:

Wednesday, March 16th

- UAH, President Zelenskyy speech

- USD, President Biden speech

- USD, Fed Interest Rate Decision

- USD, Fed’s Monetary Policy Statement

- USD, FOMC Economic Projections

- USD, FOMC Press Conference

- NZD, Gross Domestic Product (QoQ)(Q4)

- NZD, Gross Domestic Product (YoY)(Q4)

Thursday, March 17th

- AUD, Employment Change s.a.(Feb)

- AUD, Unemployment Rate s.a.(Feb)

- EUR, ECB’s President Lagarde speech

- GBP, Bank of England Minutes

- GBP, BoE Asset Purchase Facility

- GBP, BoE Interest Rate Decision

- GBP, BoE MPC Vote Rate Cut

- GBP, BoE MPC Vote Rate Hike

- GBP, BoE MPC Vote Rate Unchanged

- GBP, Monetary Policy Summary

USDollar 4HR (Posted last week)

USDollar 4HR (Present)

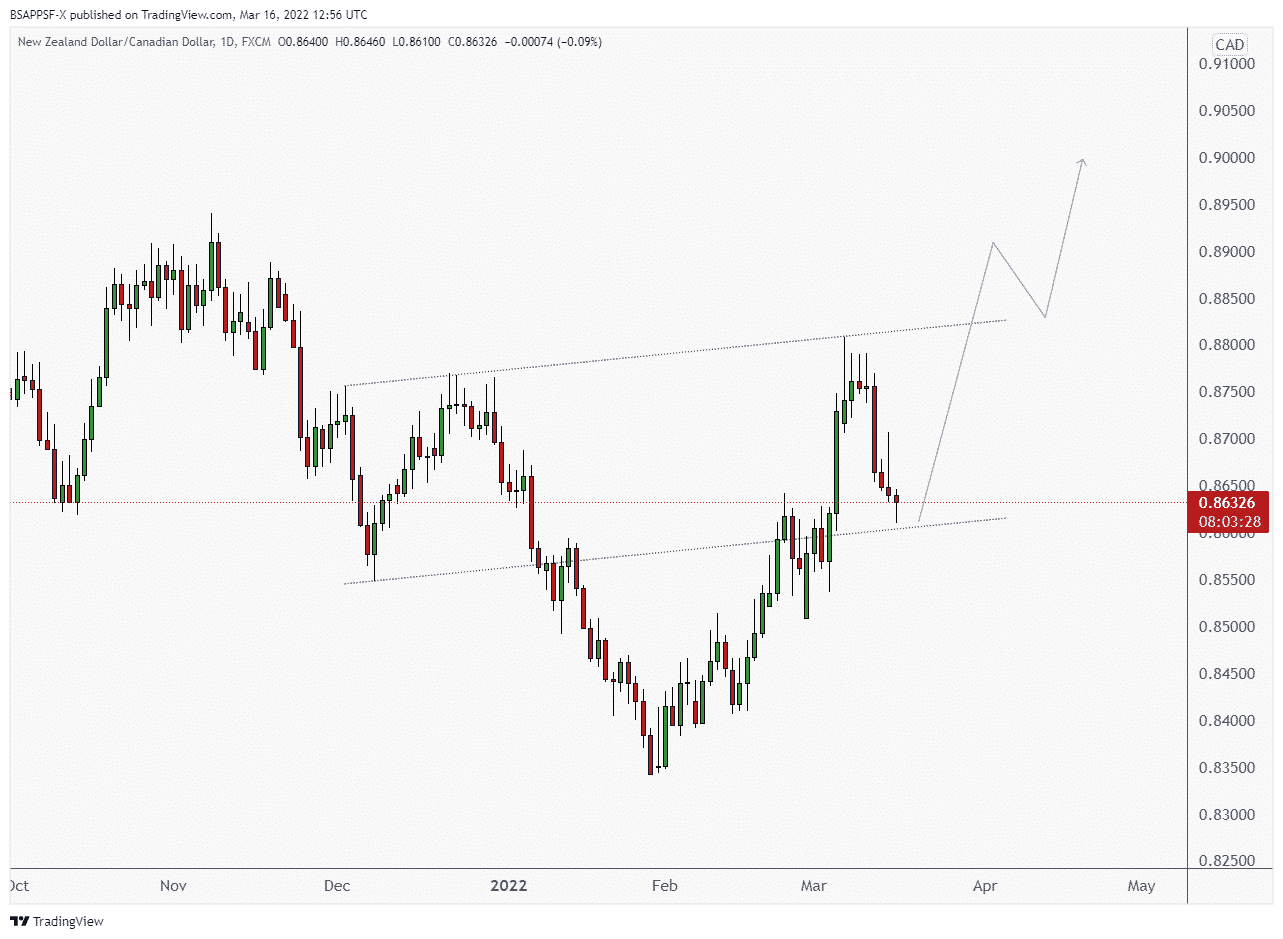

Potential Setups

Here are a few setups we will be keeping our eyes on.

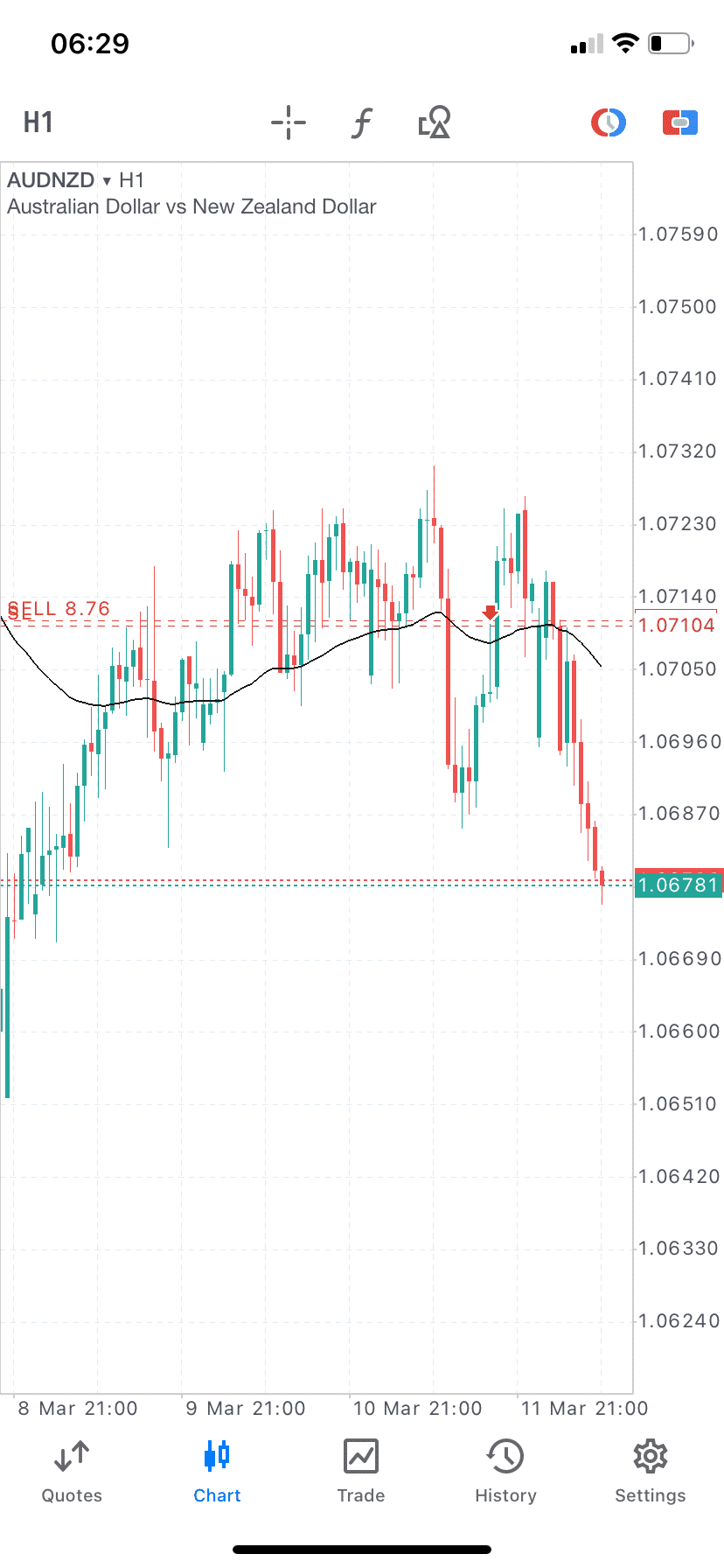

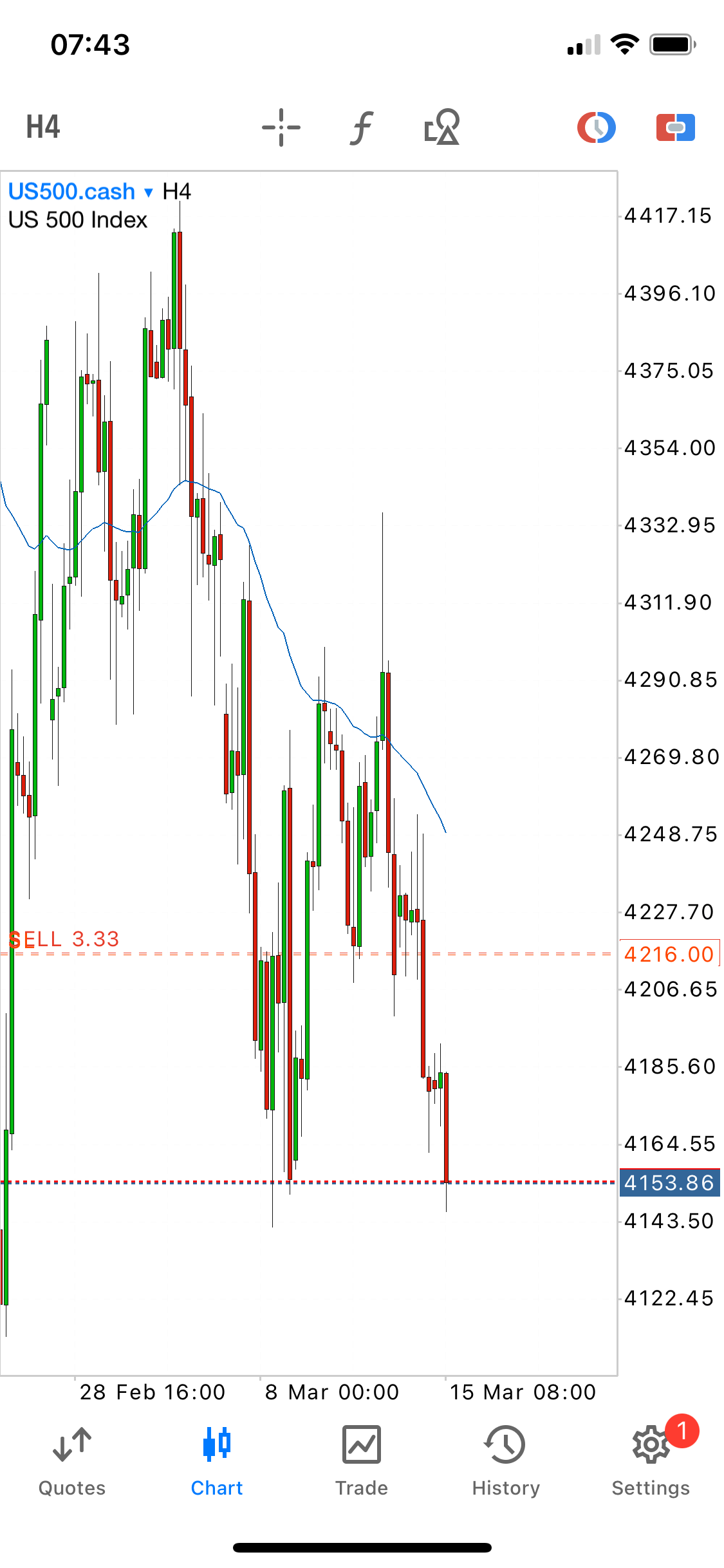

Group Wins:

Our Advance group has been smashing it recently despite tricky conditions, below are just a handful of the wins shared within the group.

Written by Aqil – Head Analyst