Currencies:

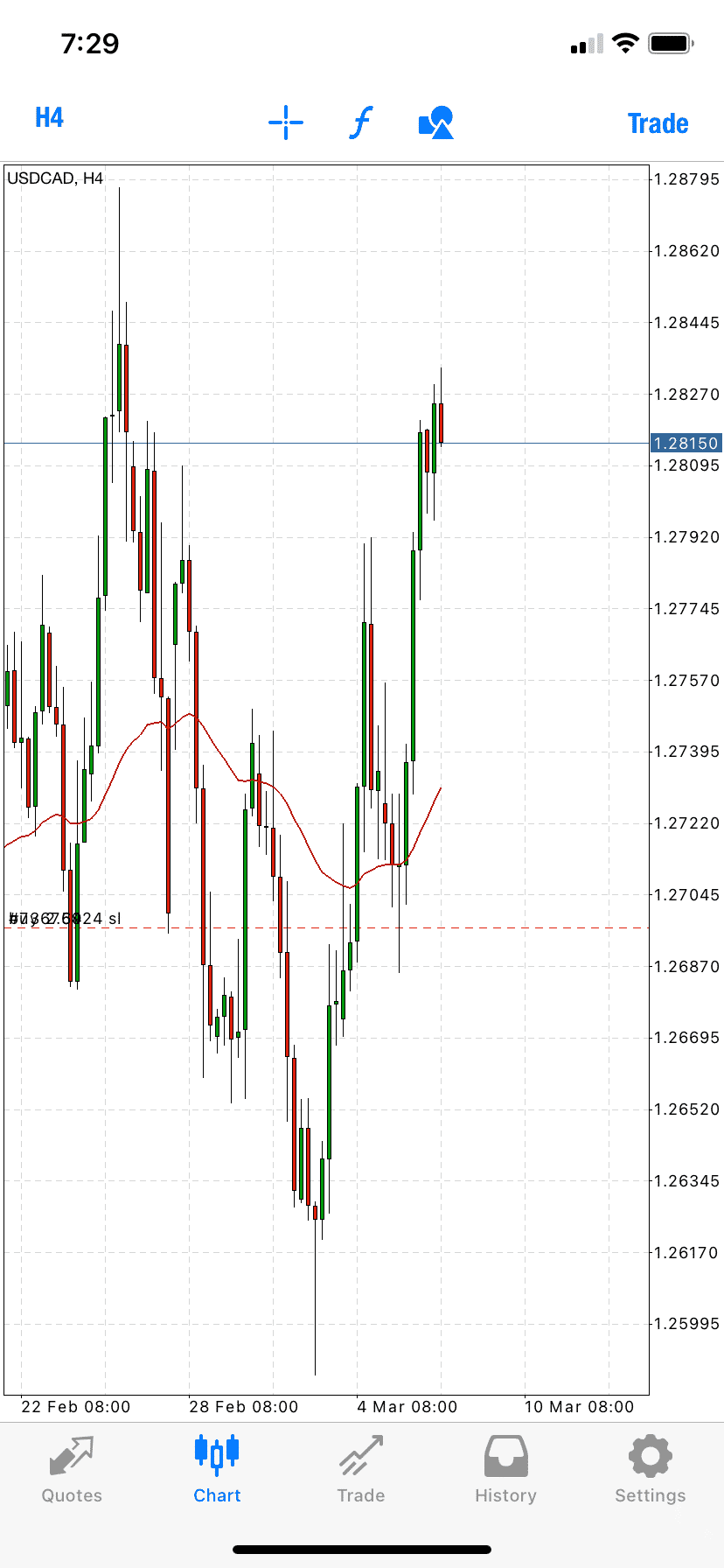

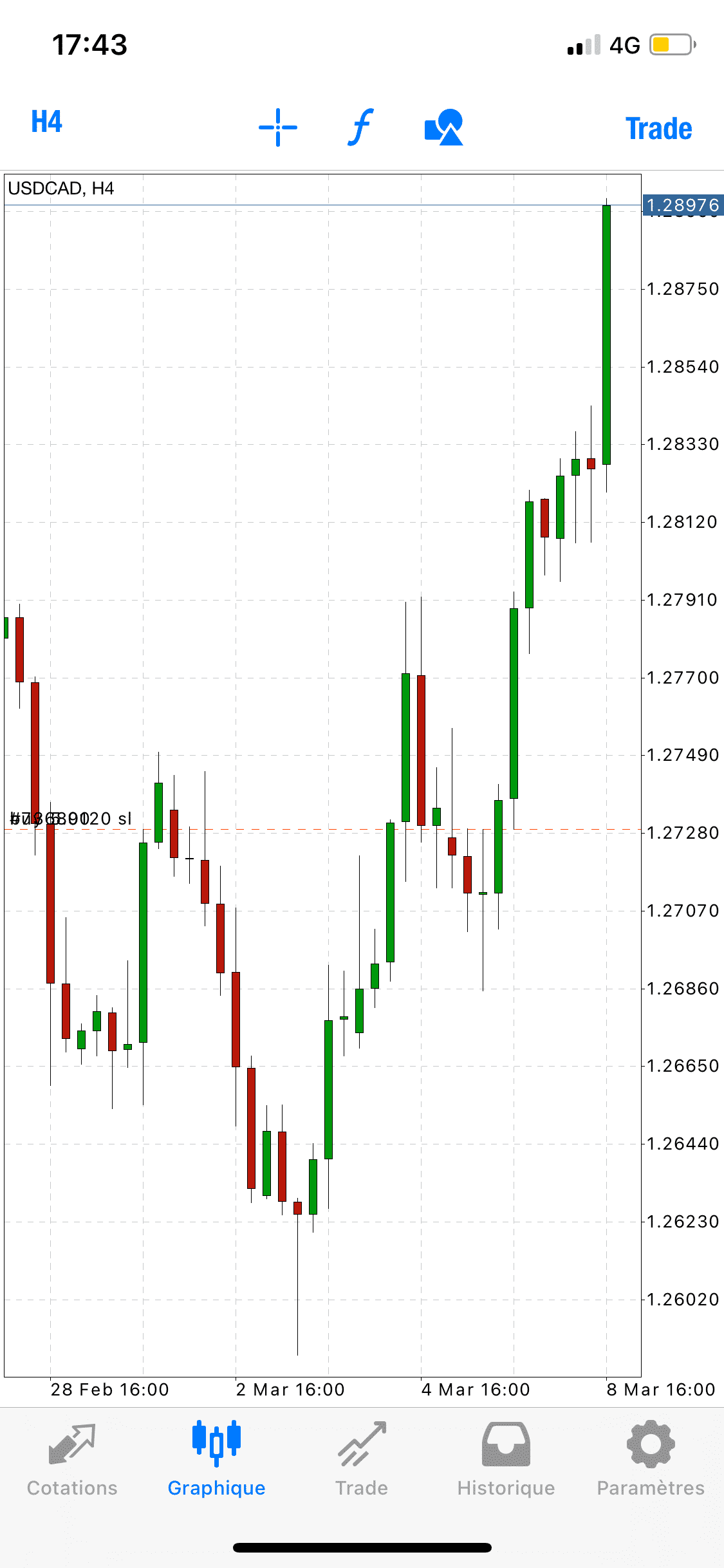

The USDOLLAR is looking nice for continued longs, as we are swinging nicely right now. We have seen a slight pullback today, but we will continue to long on any pullback. We still need to be careful regarding ongoing conflict in Ukraine where things can change very quickly. We recommend being extra cautious regarding trading during this time, making sure your risk exposure is in check so you are not over exposed if things take a turn.

There are some setups we are watching closely, mostly looking to continue the trend on pairs such as GBPUSD, EURUSD, USDCAD, GBPJPY and EURJPY.

Upcoming fundamental releases we have are:

Thursday, March 10th

- EUR, ECB Deposit Rate Decision

- EUR, ECB Interest Rate Decision

- ECB Monetary Policy Decision Statement

- USD, Consumer Price Index ex Food & Energy (MoM)(Feb)

- USD, Consumer Price Index ex Food & Energy (YoY)(Feb)

- EUR, ECB Press Conference

- AUD, RBA’s Governor Lowe speech

Friday, March 11th

- EUR, Harmonized Index of Consumer Prices (YoY)(Feb)

- CAD, Net Change in Employment(Feb)

- CAD, Unemployment Rate(Feb)

- USD, Michigan Consumer Sentiment Index(Mar) PREL

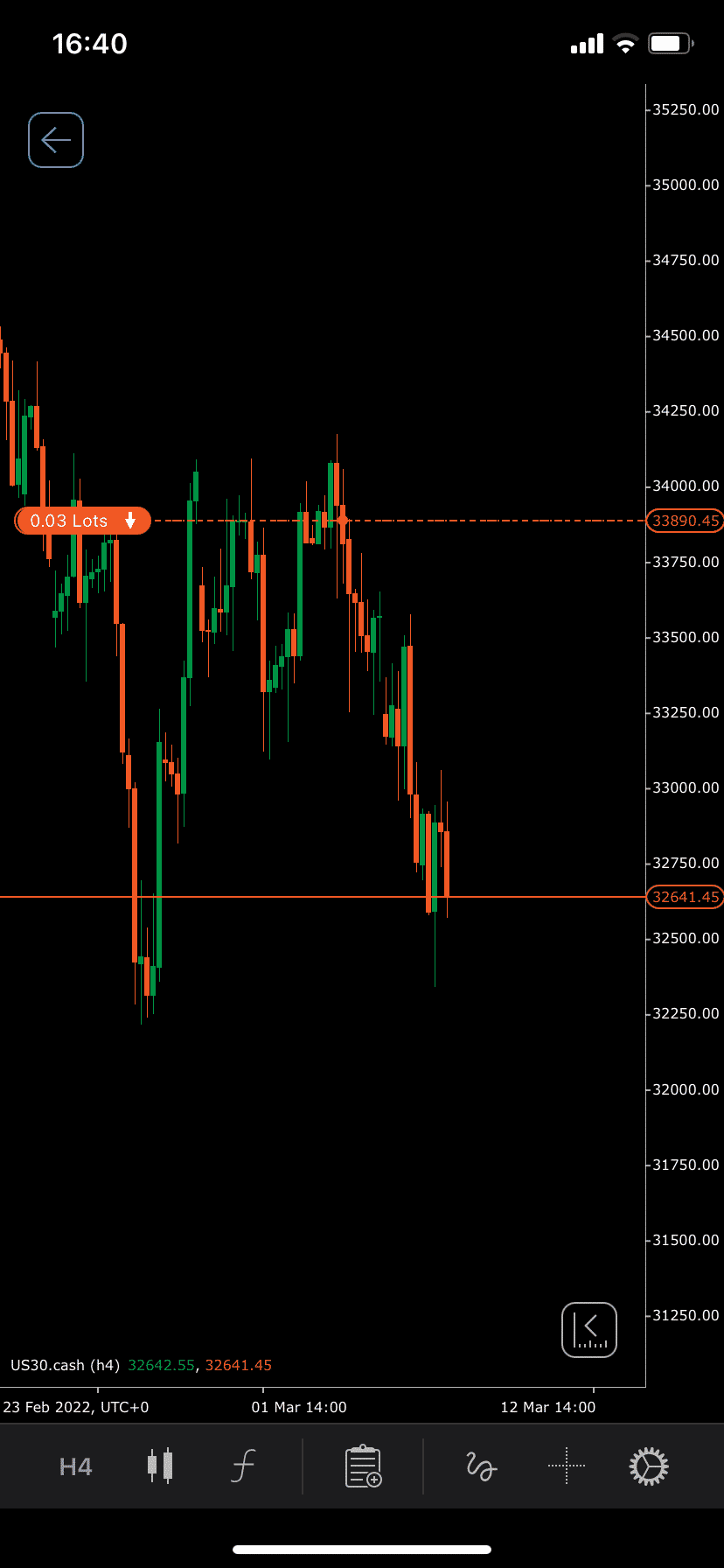

USDollar 4HR

USDollar Daily

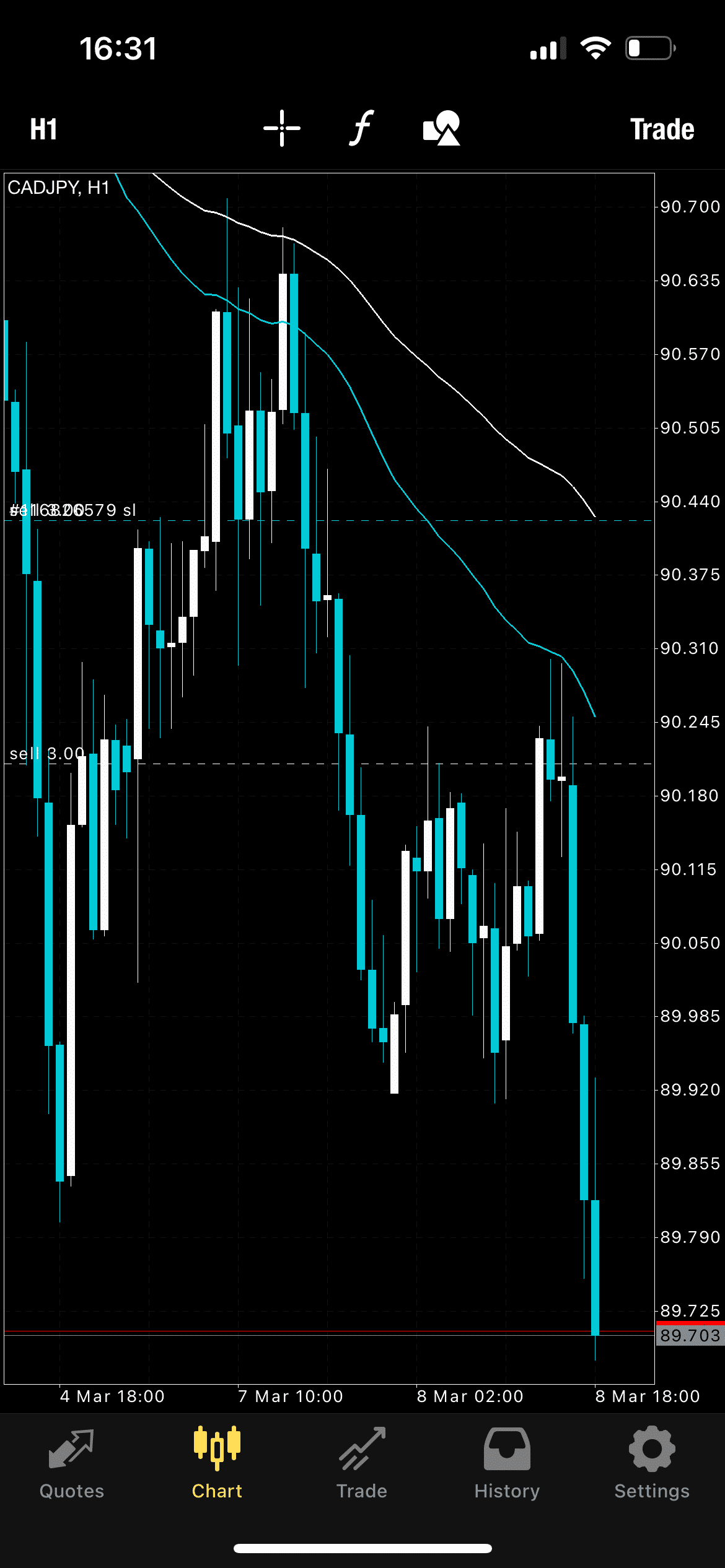

Potential Setups

Here are a few setups we will be keeping our eyes on.

Group Wins:

Our Advance group has been smashing it recently despite tricky conditions, below are just a handful of the wins shared within the group.

Written by Aqil – Head Analyst