Currencies:

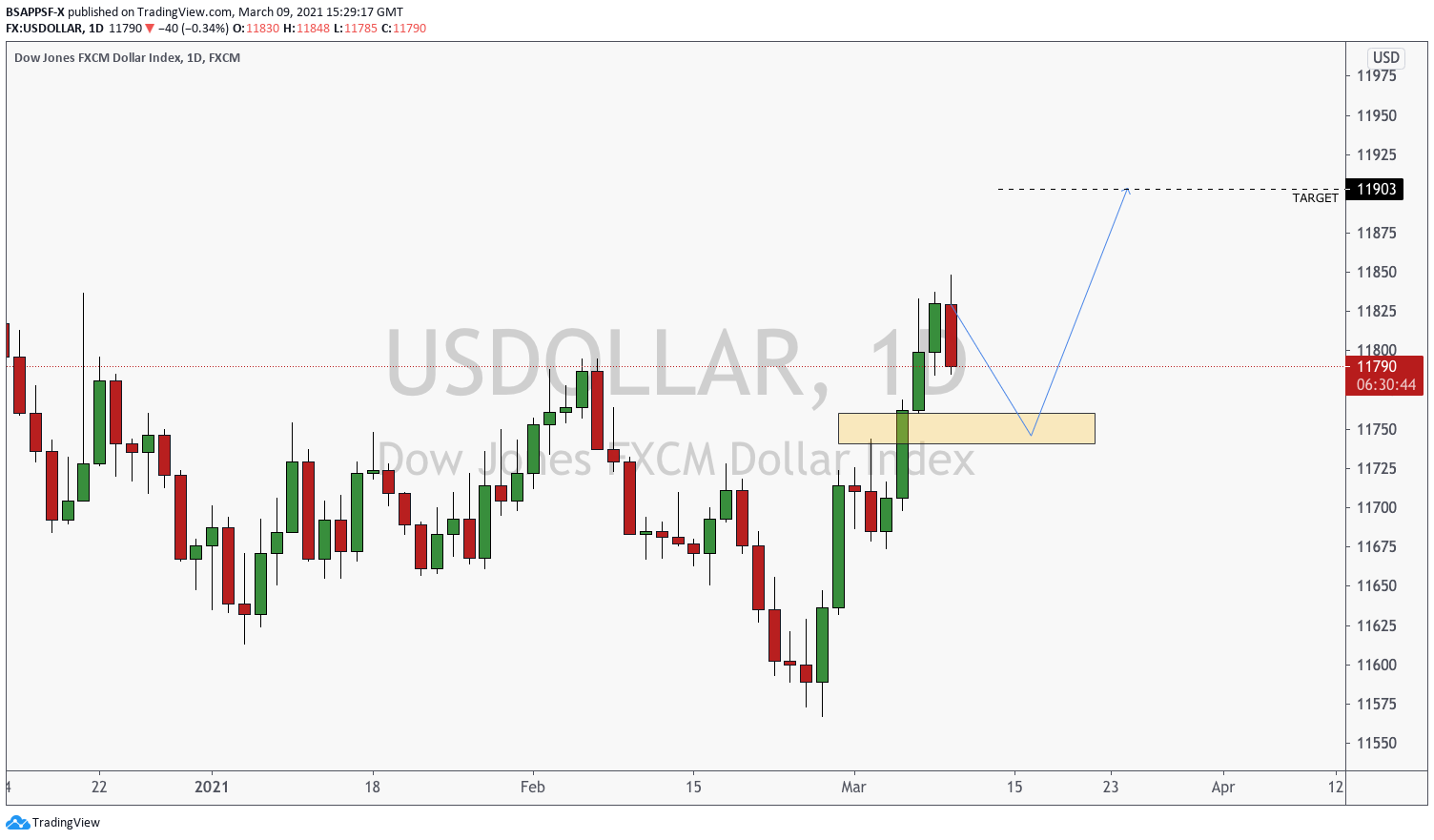

USD strength has been coming into play over the last week after having months of bearish pressure. Our macro-outlook for the dollar over the coming months is to see the bearish pressure to continue. However, a pullback Is necessary on the dollar and makes the downwards moves sustainable – over the coming weeks we may see the dollar edge up higher as we get a deeper retracement. The comments from the FED last week which has left positive market sentiment around the dollar and is a contributor to the current USD strength we are seeing.

Over the last few weeks, the EURO has been very weak across the board, with EUR/USD hitting fresh lows of 1.8352 at the time of writing. More downside is expected with the EURO, especially as the sentiment around the dollar is more bullish which could see EUR/USD to our next downside target of 1.17.

GBP has seen a substantial move to the upside over the last few months with GBP/USD hitting 1.42 – the highest it’s been since April 2018. However, due to the dollar strength we are seeing, the pound is starting to have a breather and is currently trading at 1.39 – 300 pips lower. We are looking for further downside on the pound as the dollar continues to strengthen. However, the macro-outlook for the pound is continued strength – and a pullback allows us to get long positions on this.

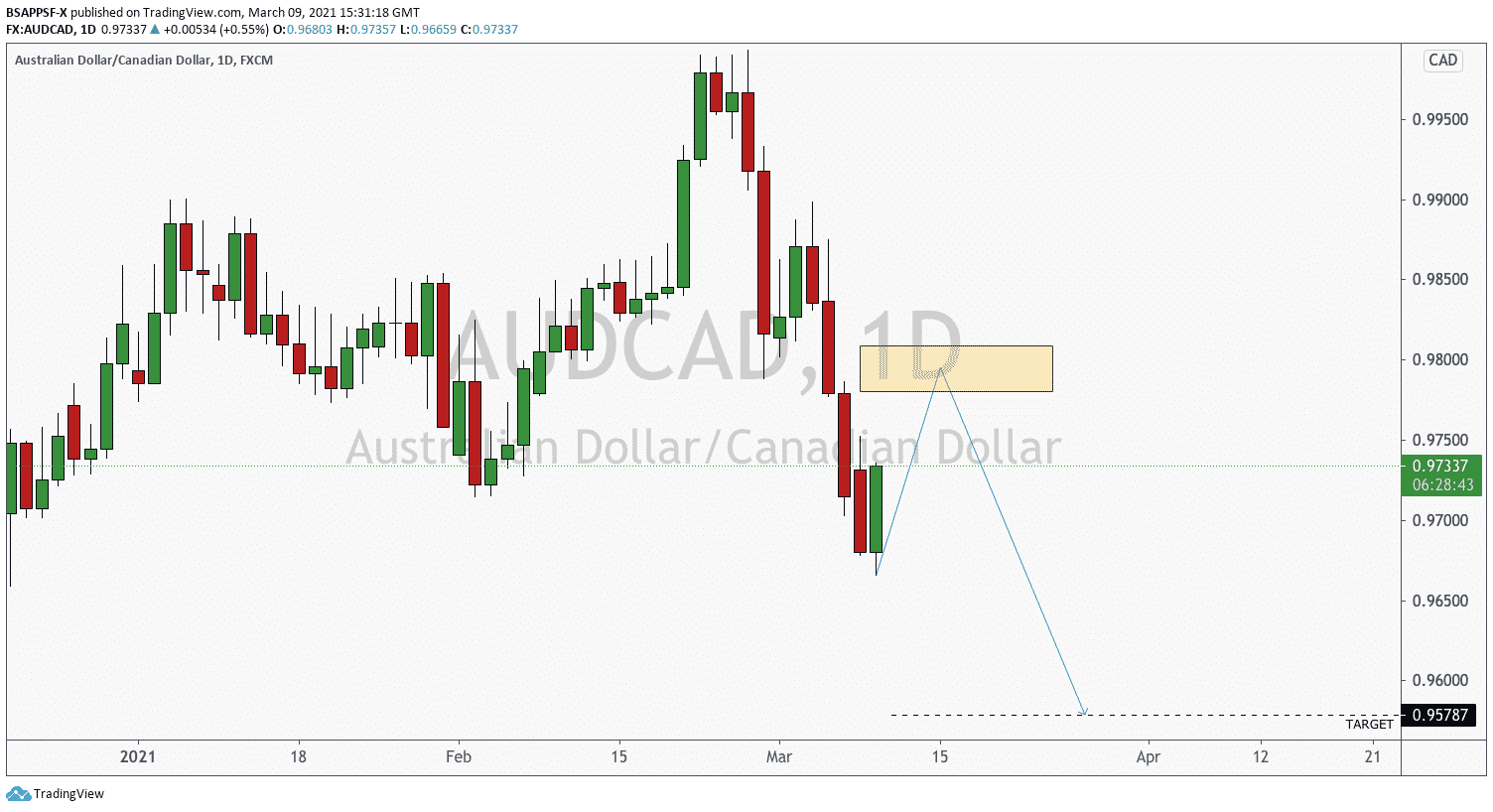

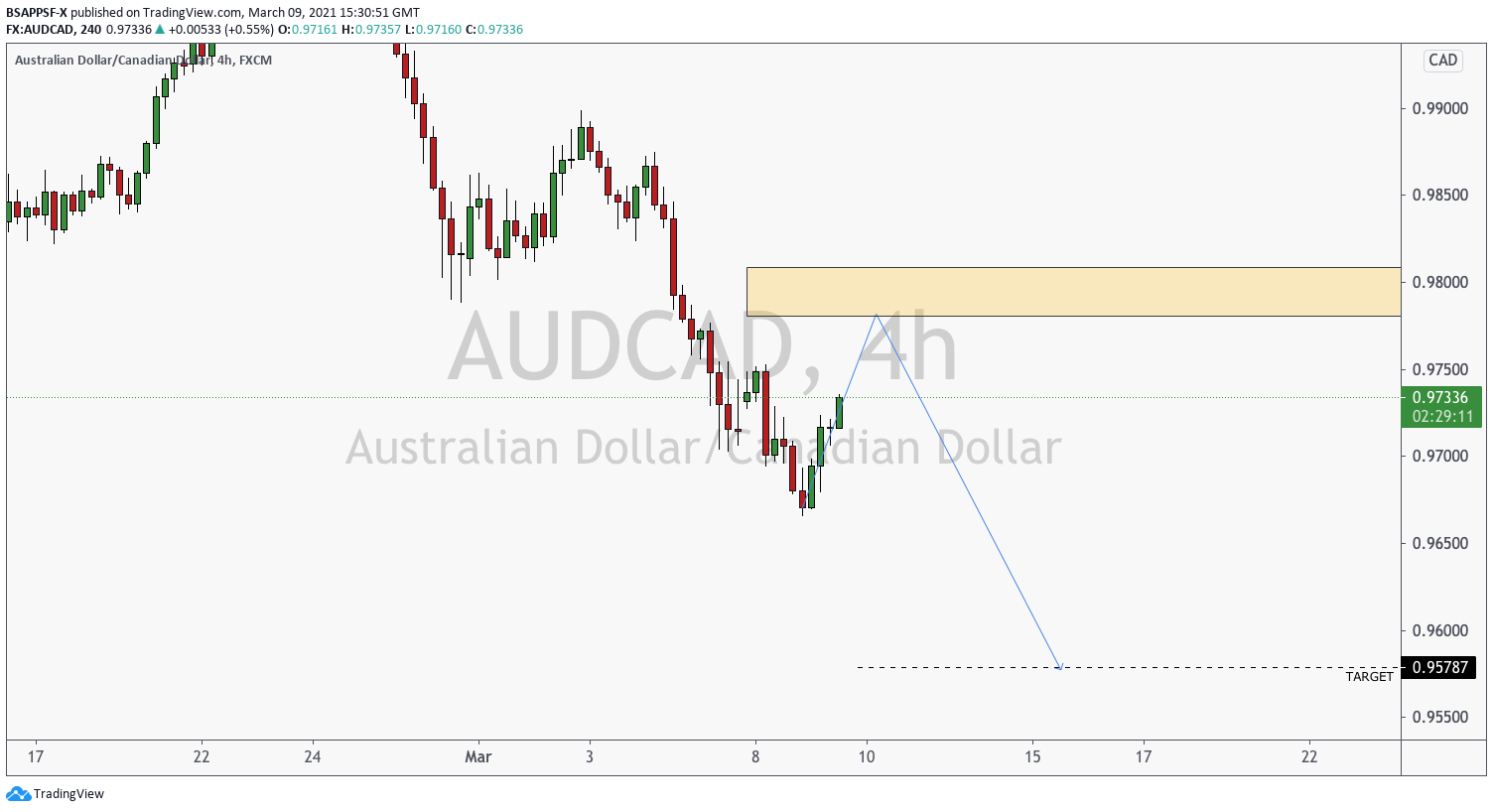

After months of bullish movement on both AUD and NZD, we are starting to see much needed pullbacks happen across the board – With AUD/USD being pushed down over 400 pips during the last 2 weeks. More downside is expected across the board with these pairs, especially as the current bullish sentiment around USD continues.

Commodities:

USOIL has been heavily bullish, and we have seen a massive 42% gain in 2021 alone. We are anticipating further upside for USOIL as the fundamentals around oil continue to get stronger. The world is starting to recover from the pandemic and things are starting to move again which will ultimately lead to an increase of oil usage – so further upside is expected overall. However, we could start to see a well-needed pullback occur as we see flows into the dollar causing commodities to have a breather. This pullback would give us great opportunities to get into swing-long positions and take USOIL up much higher.

GOLD has seen a push to the downside as the bullish sentiment around the dollar comes in. It is currently down over 10% since the beginning of the year. Our long term view on GOLD is for continued weakness this year – flows out of safe havens make sense as the global economy starts to move again.

Cryptocurrencies:

BITCOIN is on the move again after hitting a high of 58k before pulling back to 44k and is currently trading at 55k. We are looking for further upside across the board with cryptos with upside BTC targets taking us up to 70k. Before we have the big next leg, we could see a pullback down to 52k which would allow us to add to our long positions.

Potential Set Ups: USDOLLAR Index

Potential Set Ups: AUD/CAD

Written by Aqil – Senior Analyst